Ohio Energy Report: July 2025

PJM 2026/2027 Capacity Price Soars to New Historic High

On July 22, 2025 PJM Interconnection (“PJM”) announced the results for its Planning Year 2026/2027 Base Residual Auction (BRA). The BRA auction price soared to a new historic high, coming in at the Federal Energy Regulatory Commission’s approved cap of $329.17/Megawatt (MW)-day. This is a $59.25/MW-day increase from the current delivery year’s (DY) BRA capacity price of $269.92/MW-day and a $300.25/ MW-day increase from the June 1, 2024 – May 31, 2025 DY price of $28.92/MW-day. This is over 11x higher than the prior DY. The latest BRA price clearly suggests that electricity demand continues to outstrip supply, serving as a price signal for developers to build more power plants.

Non-residential customers currently contracted for generation contracts that pass through the capacity subcomponent will see this increase/decrease in capacity charges based on their Peak Load Contribution (PLC) value for the 2026/2027 DY, which will be based on how you consume power during the five coincident peaks (5CPs) that are set during this summer (i.e., June 1, 2025 – September 30, 2025). The 5CPs are the five hours (occurring on unique days) each summer when the PJM grid peaks.

If customers with interruptible capacity have not already taken action based on the capacity price increase that went into effect on June 1, 2025, we advise you to give serious consideration to contracting for an emergency demand response program to help offset these high capacity charges.

The third and only incremental auction (IA) for the 2026/2027 delivery year is scheduled to take place in February 2026. As historical trends suggest, we expect the IA price to be in close alignment with the BRA price.

If you have questions about how you may be impacted by the BRA price for the 2026/2027 DY or are interested in exploring emergency demand response, please contact Brandon Powers.

PUCO Approves New Data Center Tariff for AEP Ohio

Earlier this month, on July 9, 2025, the Public Utilities Commission of Ohio (PUCO) issued its Opinion and Order (“Order”) in AEP Ohio’s Data Center and Mobile Data Center Tariff Application, originally filed in May 2024 in response to the rapid load growth driven by data centers in its service territory. The Order approved, with modifications, the provisions outlined in an October 23 settlement stipulation supported by AEP Ohio, PUCO Staff, the Office of the Ohio Consumers’ Counsel, and others.

In the Order, the PUCO acknowledged the substantial increase in electric demand AEP Ohio is experiencing, which necessitates major upgrades to the transmission system. The Commission emphasized that the approved provisions serve the public interest by protecting non-data center customers from cost-shifting risks associated with underutilized infrastructure.

Following the PUCO’s Order, AEP Ohio lifted its moratorium on new data center connections, and on July 11, filed its new Data Center Tariff (Schedule DCT).

Schedule DCT applies to new data center or mobile data center customers with monthly maximum demand exceeding 25 MW at a single location. Existing data center customers are grandfathered under their current general service tariffs unless they plan to increase load by more than 25 MW after the new tariff’s effective date.

The tariff includes initial contract terms of eight years, plus a load ramp period not to exceed four years. It also defines terms for early termination fees, minimum billing demand, base distribution charges, collateral requirements, and behind-the-meter generation. Notably, customers taking service under Schedule DCT are not eligible to participate in AEP Ohio’s 1CP or 6CP pilot programs for transmission charges.

If you are a prospective data center customer considering sites in Ohio and have questions on Schedule DCT or how it compares to tariffs for other electric distribution utilities, please contact Katie Emling.

Peak Loads for Summer 2025

Brakey Energy provides email and text alerts in advance of potential Capacity and Transmission Coincident Peaks (CPs) to those clients that elect to receive them. As of July 23, 2025, Brakey Energy has issued 9 Capacity CP alerts, 9 FE (ATSI Zone) Transmission CP alerts, and 2 AEP Ohio CP alerts during Summer 2024. Brakey Energy also issued 5 winter alerts for the AEP Zone in January of this year.

Capacity CPs occur during the five one-hour intervals when demand on the PJM grid is at its highest. Transmission CPs for FE customers occur during the five one-hour intervals when demand on FE’s zonal grid is at its highest. The Transmission CP for AEP customers occurs during the one-hour interval when demand on AEP’s zonal grid is at its highest.

The tables below list PJM’s and FE’s five highest loads and AEP’s single highest load this year, as well as the day and time of each occurrence. This is based on preliminary data.

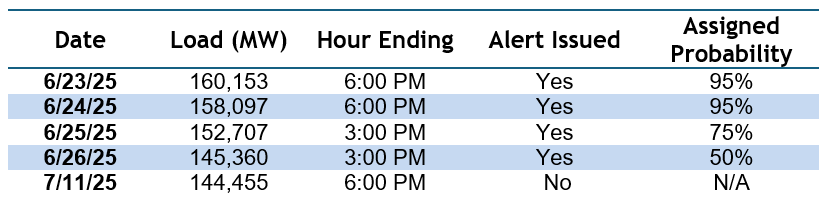

Table 1: Five Highest Loads for PJM through July 22, 2025

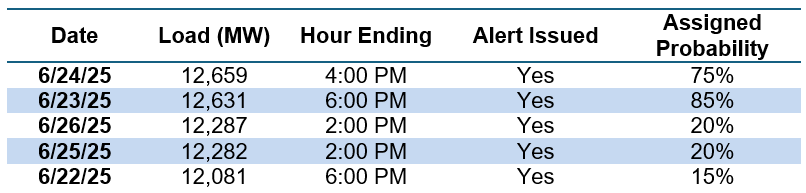

Table 2: Five Highest Loads for FE through July 22, 2025

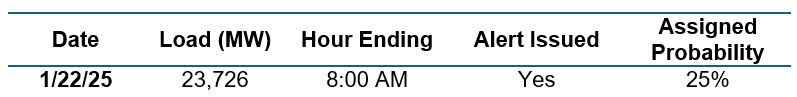

Table 3: Single Highest Load for AEP through July 22, 2025

The summer CP season ends on September 30, which is still more than two months away, however we believe there is a strong probability that many of the PJM and ATSI loads listed in the tables above, particularly the top three, will be CPs at the end of summer. Similarly, we maintain our belief that there is a strong likelihood that AEP’s load on January 22, 2025 will set AEP Zone’s 1CP for the November 1, 2024, through October 31, 2025 CP year.

Brakey Energy will continue monitoring weather and load forecasts and will issue alerts to participating clients as warranted. If you are a Brakey Energy client and would like to receive these alerts, please contact Catherine Nickoson.

Residential Corner

The sky-high Base Residual Auction (BRA) clearing price has resulted in all offers being materially higher than what customers are accustomed to. Users looking to hide on a low short-term rate can contract with American Power & Gas for three months at a low 6.09¢ per kWh. Just know that this is a teaser rate and be sure to enter into a new contract before expiration to avoid a sky-high holdover provision!

For those who have been under American Power & Gas for a teaser rate in the last year, they probably will not let you sign up for that promotional offer. In that case, Major Energy is offering a similar three-month offer for 6.39¢ per kWh.

The best longer term option is a 8.29¢ 12-month offer from Energy Harbor. These types of high prices are going to be a shock to residential customers, but there is no getting around this surge in capacity prices.

Regarding natural gas, Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide a termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

The NYMEX price for July settled at $3.261 per Million British Thermal Units (MMBtu) on June 26, 2025. This price is up 1.8% from the June 2025 price of $3.204 per MMBtu. This settlement price is used to calculate July gas supply costs for customers that contract for a NYMEX-based index gas product.

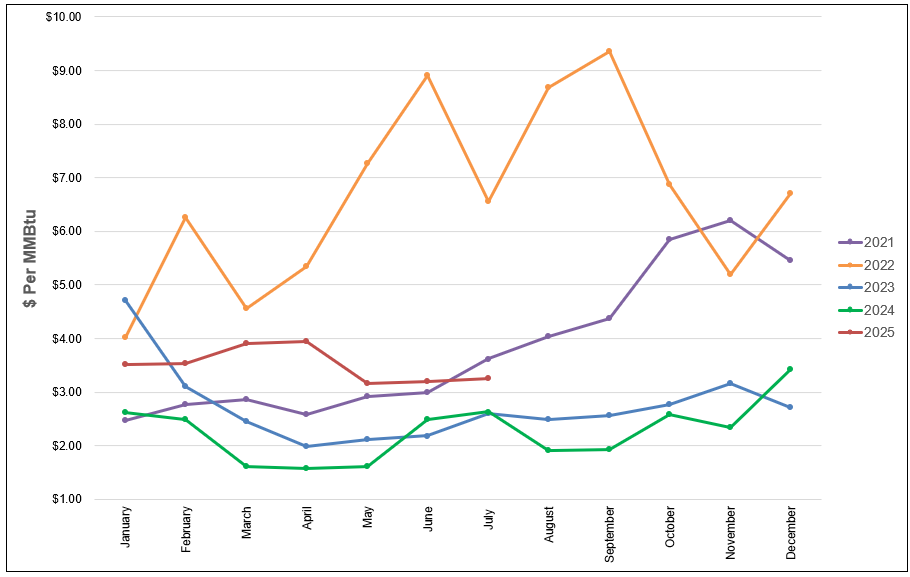

The graph below shows the year-over-year monthly NYMEX settlement prices for 2021, 2022, 2023, 2024, and 2025 year-to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

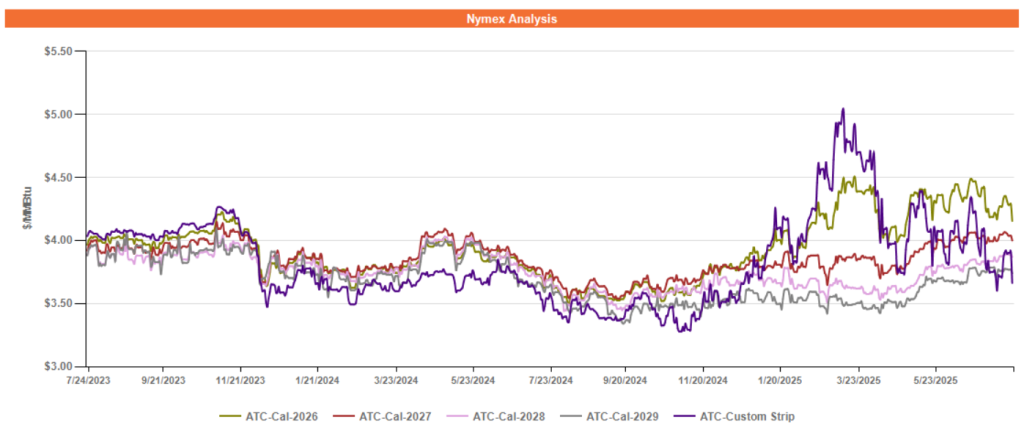

Figure 2 below shows the historical July 23, 2023 through July 23, 2025 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2025 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, and 2029.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Forward natural gas prices for the balance of 2025 have been volatile but have softened overall since the beginning of summer. Domestic production has remained strong despite initial worries to the contrary, with production in July thus far averaging 107 BCF/d – an increase over June’s average of 106.5 BCF/d – and near all-time highs. Recent storage injections have also been robust, and storage levels are now at a 6.2% surplus to the trailing 5-year average.

Strong production and healthy storage levels have also contributed to recent softness in winter 2026 forward gas prices. However, the second half of 2026 is buoying 2026 forward prices overall and keeping the market in a state of backwardation. More LNG export capacity is expected to come online this fall and in early next year, which could put pressure on storage levels heading into next summer, and is helping to keep forward prices in latter 2026 at elevated levels.

Electricity Market Update

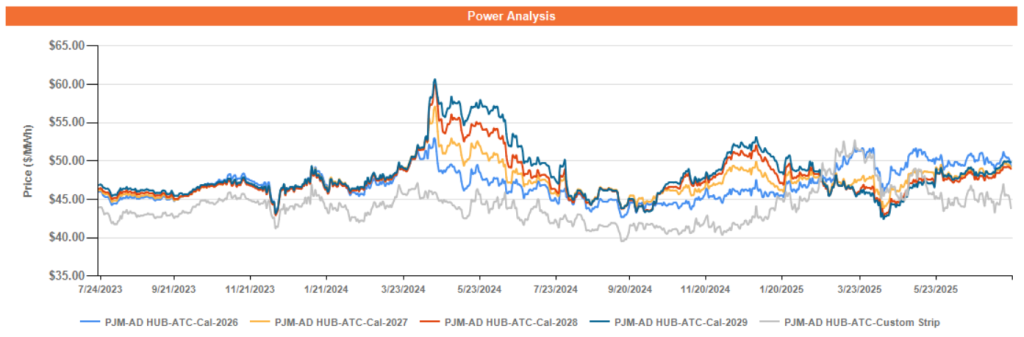

Figure 3 below shows the historical July 23, 2023 through July 23, 2025 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2025 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, and 2029 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

*Pricing courtesy of Direct Energy Business.

Forward power prices have slowly trended upward and have converged on one another in recent weeks, as market participants have been awaiting the results of the aforementioned BRA capacity auction. As the auction results are digested in the coming days and weeks, price discovery may lead to more volatility compared to what has so far been a relatively sleepy summer in the forward power market.