Ohio Energy Report: October 2025

FirstEnergy’s Rider NMB Rates Updated on October 1, 2025

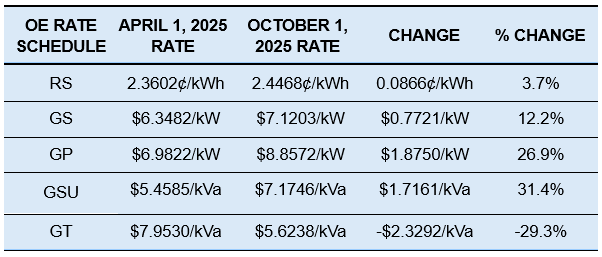

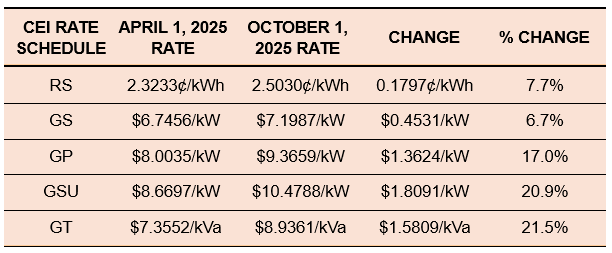

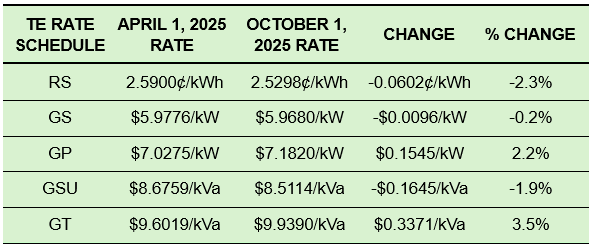

FirstEnergy (FE) implemented a semi-annual update to its Non-Market-Based Services Rider (Rider NMB) rates on October 1, 2025, for residential and nonresidential customers served by its three Ohio operating companies: Ohio Edison (OE), the Illuminating Company (CEI), and Toledo Edison (TE). Rider NMB recovers FE’s non-market-based transmission and ancillary service costs, with the largest component being PJM’s Network Integration Transmission Service charge.

Although Rider NMB is typically updated annually on April 1, FirstEnergy filed an interim adjustment application in July 2025 to account for a $5.7 million reconciliation. The updated rates proposed by FE’s filing were approved by the Public Utilities Commission of Ohio (PUCO) last month.

The tables below show previous and current Rider NMB rates for OE, CEI, and TE under the Residential (RS), Secondary (GS), Primary (GP), Subtransmission (GSU), and Transmission (GT) rate schedules. Rates are billed per kilowatt-hour (kWh) for RS customers and per kilowatt (kW) or kilovolt-ampere (kVA) for GS, GP, GSU, and GT customers.

As shown in the tables, Rider NMB increases primarily affected OE GP and GSU customers, as well as CEI customers served above secondary voltage. In contrast, OE GT customers experienced a 29.3% decrease in Rider NMB rates effective October 1.

Table 1: OE Rider NMB Rates

Table 2: CEI Rider NMB Rates

Table 3: TE Rider NMB Rates

Clients that are participating in FE’s transmission pilot program are opted out of paying the NMB rider. If you have any questions about how the new NMB rates will impact your electric costs, please contact Katie Emling.

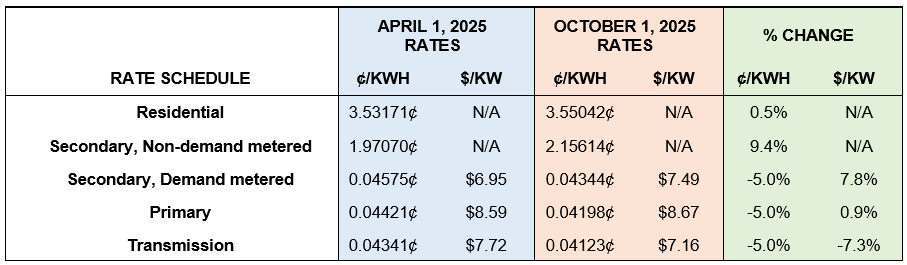

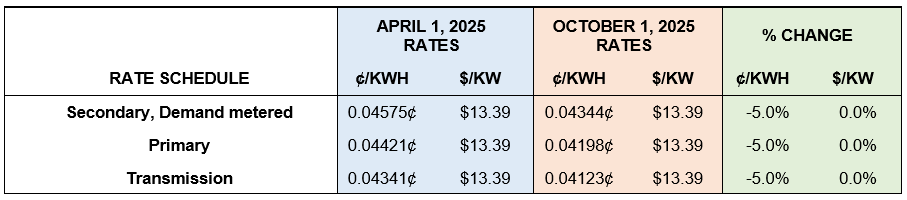

AEP Ohio’s Transmission Rates Updated on October 1, 2025

Last month, the PUCO approved AEP Ohio’s updated Basic Transmission Cost Rider (BTCR) rates, which took effect on October 1, 2025. The semi-annual update most negatively impacted Secondary voltage customers, while General Service Transmission customers who do not participate in the transmission pilot saw the largest rate decreases.

General Service Secondary non-demand-metered customers experienced a 9.4% increase in their BTCR rate. For demand-metered Secondary customers, the kWh-based portion of transmission charges decreased by 5%, but the demand-based portion increased by approximately 7.8%.

The demand component of BTCR rates for interval-metered nonresidential customers enrolled in AEP Ohio’s Transmission Pilot Program was unaffected by this update. Pilot participants continue to have their demand charges calculated based on their load during AEP’s annual 1CP hour, rather than the standard method using monthly billed demand. For this reason, no rate reconciliation was needed since actual cost recovery is being met as forecasted.

The tables below summarize the current and April 1, 2025, BTCR kWh- and kW-based rates for both standard and pilot program customers, along with the percentage change for each rate.

Table 4: Previous and October 1, 2025 BTCR Rates for AEP Ohio Customers

Table 5: Previous and October 1, 2025 for AEP Ohio Customers Participating in the Transmission Pilot Program

If you would like more information about how the BTCR impacts your monthly electric costs, please contact Katie Emling.

AEP Ohio’s Transmission Pilot Program Queue to Re-Open December 1

Enrollment for AEP Ohio’s Basic Transmission Cost Rider (BTCR) Pilot Program opens December 1, 2025, on a first-come, first-served queue. This expansion stems from a PUCO-approved settlement in AEP Ohio’s ESP V case, which permits an additional 100 MW of participation each program year during ESP V (June 1, 2024–May 31, 2028). Eligible existing nonresidential customers have until December 31, 2025, to enroll, with participation beginning April 1, 2026.

Participants’ transmission charges will be based on their Network Service Peak Load (NSPL) rather than monthly billed demand at AEP Ohio’s BTCR rate. Savings depend on how a facility performs during AEP’s annual 1CP hour (the single PJM-coincident peak used for allocation). The pilot may be a good fit for non-weather-sensitive loads, operations that run primarily off-peak, or customers able to shift load away from likely peak hours.

For more information on AEP Ohio’s transmission pilot program and the utility’s enrollment queue process, please contact Katie Emling.

Residential Corner

The sky-high Base Residual Auction (BRA) clearing price has resulted in all generation offers being materially higher than what customers were once accustomed to.

While a few teaser rates remain available, the best longer term option is a 8.69¢ 15-month offer from Energy Harbor.

Regarding natural gas, Brakey Energy has long and often found defaulting to distribution utilities’ Standard Choice Offer a prudent strategy for natural gas supply. However, Columbia Gas of Ohio (“Columbia”) rates have recently jumped. For Columbia customers, and for any customer wanting price certainty this winter, Energy Harbor is currently offering a six-month deal for $0.5690/ccf. This price will vary depending on distribution utility.

Natural Gas Market Update

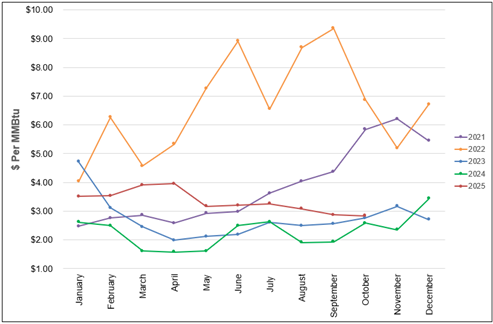

The NYMEX price for October settled at $2.835 per Million British Thermal Units (MMBtu) on September 26, 2025. This price is down 1.1% from the September 2025 price of $2.867 per MMBtu. This settlement price is used to calculate October gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2021, 2022, 2023, 2024, and 2025 year-to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

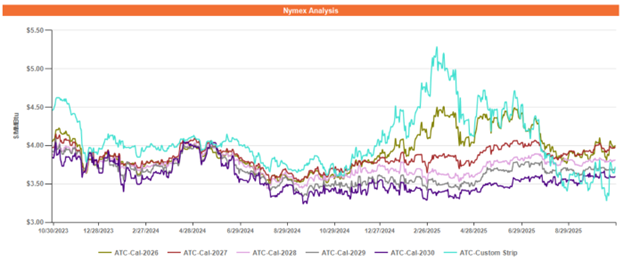

Figure 2 below shows the historical October 29, 2023 through October 29, 2025 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2025 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, 2029, and 2030.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Forward natural gas prices, primarily through Q2 2026, have experienced elevated volatility in recent weeks. This can be primarily attributed to three factors: decreasing domestic gas production, increasing liquefied natural gas (LNG) export demand, and early chilly weather increasing heating demand. As this winter approaches, volatility in these months’ forward contracts will likely continue.

Beyond Q2 2026, forward gas prices have traded mostly flat in recent weeks. The market continues to price in the expectation of a global LNG supply glut, which would lead to more gas staying in the domestic market and depressing domestic gas prices in the future.

Electricity Market Update

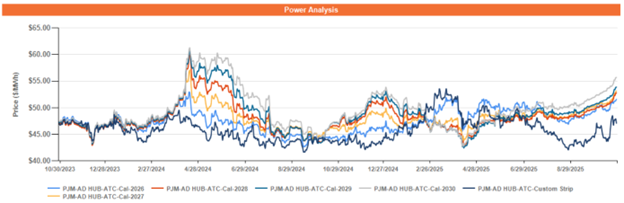

Figure 3 below shows the historical October 29, 2023 through October 29, 2025 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2025 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, 2029, and 2030 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

*Pricing courtesy of Direct Energy Business.

Like the gas market, forward power prices through Q2 2026 have experienced elevated volatility compared to outlier years. Volatility can be expected to continue for these months as winter approaches as well.

Meanwhile, in outlier years 2027 and beyond, forward power prices have steadily climbed higher and created a state of pronounced contango. A sizeable risk premium is forming in the forward power market, as PJM continues to grapple with the supply-demand imbalance. Load demand forecasts from proposed new data centers are running up against the challenge of adding additional generation capacity to the grid. These ongoing and unresolved challenges bring uncertainty to the market, leading to the formation of this risk premium.