BE PJM BRA Update: December 2025

PJM Releases 2027/2028 Delivery Year BRA Results

On December 17, 2025, PJM Interconnection announced the results of its Planning Year 2027/2028 Base Residual Auction (BRA). The auction procured 134,478.1 megawatts (MW) of unforced capacity from generation resources and demand response across the Regional Transmission Organization (RTO).

The auction cleared at $333.44 per MW-day for the entire PJM region, which includes the ATSI, AEP, DAY, and DEOK transmission zones. This price matched the Federal Energy Regulatory Commission’s (FERC) approved capacity price ceiling and represents a 1.3% increase compared to the prior auction for the 2026/2027 Delivery Year (DY).

Capacity Price Collar and Upcoming Auctions

The 2027/2028 DY is the second and final year in which a FERC-approved capacity price collar is in effect. Without the capacity cap in place, PJM’s simulations based on the existing offers in the auction would have resulted in an RTO-wide clearing price of approximately $542.83/MW-day, about $196.36/MW-day, or 58.9%, above the capped clearing price. It’s important to note that PJM doesn’t know how actual offers would have changed if the price collar was not in effect.

At this time, no price collar is in place for the 2028/2029 BRA, which is scheduled for June 2026. However, PJM and the Pennsylvania Public Utility Commission have jointly filed a proposal with FERC that, if approved, would establish a RTO-wide capacity price cap of $550 per MW-day. Under the proposal, individual transmission zones could have higher or lower caps depending on local conditions, with proposed limits ranging from approximately $483 to $785 per MW-day.

Reliability Concerns and Supply Shortfall

In its press release announcing the auction results, PJM stated that the capacity secured through the BRA, combined with Fixed Resource Requirement resources, falls short of PJM’s reliability requirement by 6,623 MW. In practical terms, the committed supply does not meet PJM’s long-standing reliability standard, which is designed to maintain a reserve margin sufficient to withstand a one-in-ten-year extreme weather or system event.

PJM Executive Vice President Stu Bresler underscored the challenge, noting that electricity demand—particularly from data centers—continues to grow faster than new supply additions. He emphasized that addressing this imbalance will require coordinated action among PJM, market participants, policymakers, and large load customers.

Historical Context

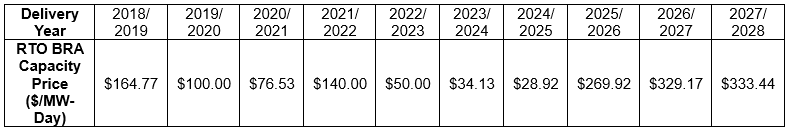

For additional context, Table 1 below summarizes PJM-wide BRA clearing prices for the past ten Delivery Years. These prices reflect the regional (RTO-wide) auction results and do not represent specific zonal prices or the results of incremental auctions.

Table 1: Historical PJM BRA Capacity Prices for the RTO Since the 2018/2019 DY

Energy Market Reaction

Forward power prices for 2027 and 2028 traded modestly higher following the announcement. Because the auction cleared at the price ceiling, the outcome was largely anticipated by market participants. However, the growing concern over future capacity shortfalls is likely to remain a key focus for the market and could contribute to price volatility going forward.