Ohio Energy Report: January 2026

Extreme Cold Results in Elevated Spot Prices and Extended Risk for AEP Zone 1CP

Beginning on January 24, a disrupted polar vortex sent temperatures across the central and eastern United States into a deep freeze. These prolonged subzero temperatures have resulted in elevated real-time and day-ahead hourly spot electric prices for customers throughout the PJM region.

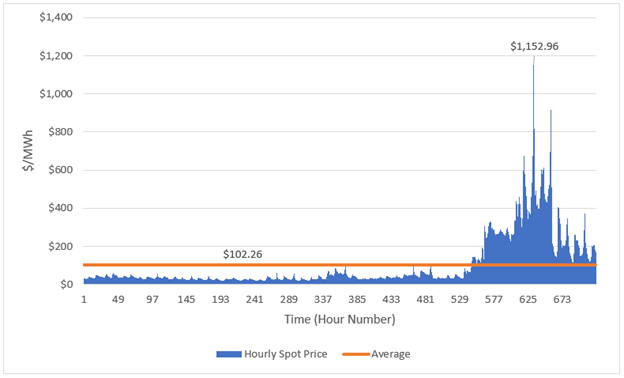

As seen in the figure below, day-ahead spot prices at the Ohio AD Hub peaked on January 27, 2026, for hour ending 08:00 AM at a whopping $1,153 per Megawatt-hour (MWh), or $1.153 per kilowatt-hour (kWh). From January 1 through January 30, the average day-ahead spot price was $102.26 per MWh or 10.226¢ per kWh. This is primarily a weather-related effect and is not expected to persist, especially if temperatures normalize next month.

Figure 1: AD Hub Day-Ahead Hourly Spot Prices, January 1 – 30, 2026

These extremely low temperatures also produced elevated loads for transmission zones that rely heavily on electricity for space heating, including the American Electric Power (AEP) Zone. As a result, Brakey Energy issued five AEP Zone Transmission Coincident Peak (CP, or 1CP) alerts to clients enrolled in AEP Ohio’s Basic Transmission Cost Rider (BTCR) transmission pilot program. These alerts spanned from January 24 through January 30, 2026. In total, Brakey Energy has issued seven AEP Zone 1CP alerts so far this winter.

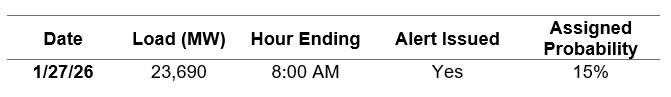

As shown in the table below, the preliminary metered load on January 27 currently holds the highest peak load to date in the AEP Zone since the current CP year began on November 1, 2025.

Table 1: Single Highest Load for AEP Zone through January 27, 2026

For context, AEP’s 1CP for the previous period (2024/2025) was 23,726 MW, only 56 MW higher than the preliminary metered load on January 27.

Brakey Energy will continue to monitor weather and load forecasts and will issue alerts to participating clients when warranted.

FirstEnergy Files April 1, 2026 Update to Non-Market-Based Services Rider

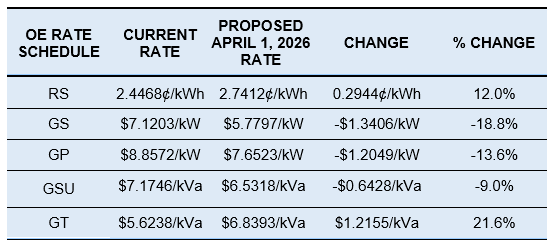

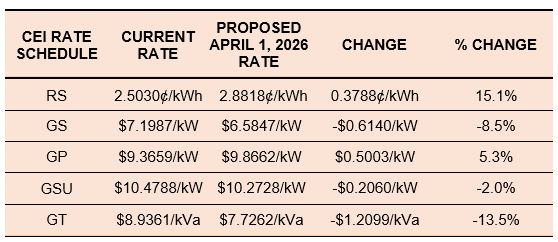

The Non-Market-Based Services Rider (Rider NMB) rates are set to change April 1, 2026 for residential and non-residential customers of FirstEnergy’s (FE) three Ohio operating companies: Ohio Edison (OE), the Illuminating Company (CEI), and Toledo Edison (TE). Rider NMB recovers FE’s non-market-based costs for transmission and ancillary services, with the largest component being PJM’s Network Integration Transmission Service (NITS) charge.

For 2026, the NITS rate in the ATSI Zone – the transmission zone serving FE’s Ohio customers—increased by 3.4% compared to 2025. Despite the NITS rate remaining near current levels, Rider NMB rates for various operating companies and customer classes will either increase or decrease based on each rate class’s share of the summer 2025 peak loads and forecasted billing determinants for the class’s cost recovery allocations.

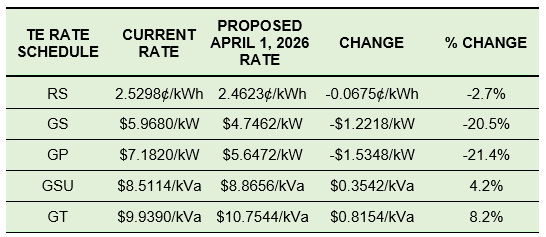

If approved by the Public Utilities Commission of Ohio, the updated Rider NMB rates will take effect on April 1, 2026. Current and proposed April 1, 2026 Rider NMB rates for OE, CEI, and TE Residential (RS), Secondary (GS), Primary (GP), Subtransmission (GSU), and Transmission (GT) rate schedules are shown in the tables below. Rates are per kilowatt hour (kWh) for RS customers and per kilowatt (kW) or kilovolt-ampere (kVa) for GS, GP, GSU, and GT customers.

Table 2: OE Rider NMB Rates

Table 3: CEI Rider NMB Rates

Table 4: TE Rider NMB Rates

Clients that are participating in FE’s transmission pilot program are opted out of paying the NMB rider. If you have any questions about this pilot program or how the new NMB rates will impact your electric costs, please contact Katie Emling.

AEP Files April 1, 2026 Update to Basic Transmission Cost Rider

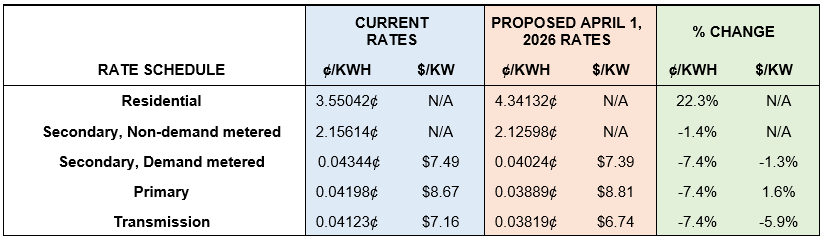

Earlier this month, AEP Ohio filed proposed April 1, 2026 rate updates for AEP Ohio’s BTCR. Based on the filing, the energy component rate for each non-residential customer class will decrease by approximately 7%. The demand-based billing component of transmission costs for the majority of AEP Ohio non-residential customers in the Secondary or Primary rate classes will be decreasing or increasing by approximately 1%, respectively. Additionally, General Service (GS) Transmission class customers can expect around a 6% decrease in the demand-based BTCR rate. These overall rate reductions can be attributed to the non-residential load growth in the AEP Ohio territory, primarily from data centers.

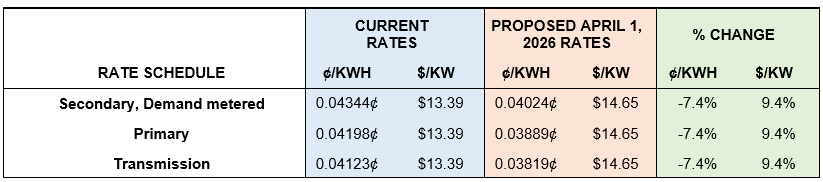

Select interval-metered customers, including Brakey Energy clients, may choose to participate in a transmission pilot program. For participants, the demand portion of BTCR charges is calculated based on the customer’s load during AEP’s 1CP, as opposed to the default method, which uses monthly billed demand.

Demand based BTCR rates for customers participating in AEP Ohio’s transmission pilot program will again be increasing by approximately 9%, just as it did last April. This rate is more than double the per kW rate billed to standard GS Transmission customers not enrolled in the transmission pilot program.

The tables below show the current and proposed April 1, 2026 BTCR kWh and kW-based rates for non-transmission pilot program customers and transmission pilot program customers of AEP Ohio. The percentage change for each rate is also summarized.

Table 5: Current and Proposed April 1, 2026 BTCR Rates for AEP Ohio Customers

Table 6: Current and Proposed April 1, 2026 for AEP Ohio Customers Participating in the Transmission Pilot Program

If you would like more information about how the BTCR impacts your monthly electric costs, please contact Katie Emling.

Residential Corner

Sky-high Base Residual Auction (BRA) clearing prices and the recent deep freeze have resulted in ever-elevating generation offers.

We recommend customers with an approaching contract expiration migrate to a short-term ten-month offer with AEP Energy for 8.89¢/kWh. We’re actually surprised they haven’t pulled this offer yet given how much power prices have spiked in the last week.

Regarding natural gas, Brakey Energy has long found defaulting to distribution utilities’ Standard Choice Offer a prudent strategy for natural gas supply. However, Columbia Gas of Ohio (“Columbia”) rates have recently jumped. For Columbia customers, and for any customer wanting price certainty this winter, Energy Harbor is currently offering a six-month deal for $0.6390 per hundred cubic feet (ccf).

Natural Gas Market Update

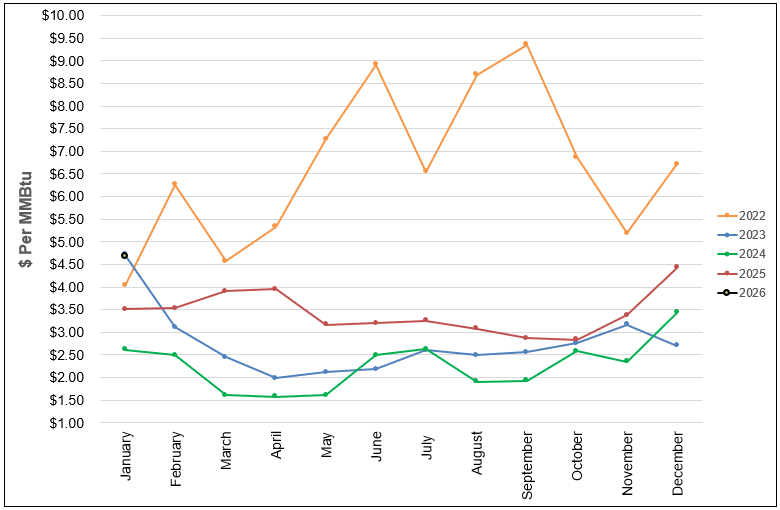

The NYMEX price for January settled at $4.687 per Million British Thermal Units (MMBtu) on December 29, 2025. This price is up 5.9% from the December 2025 price of $4.424 per MMBtu. This settlement price is used to calculate January gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2022, 2023, 2024, 2025, and January 2026. Prices shown are in dollars per MMBtu of natural gas.

Figure 2: NYMEX Monthly Natural Gas Settlement Prices

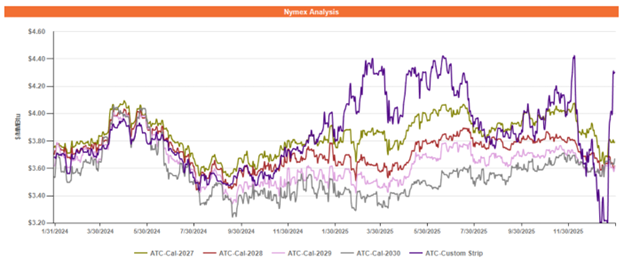

Figure 3 below shows the historical January 30, 2024 through January 30, 2026 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2026 (labeled as “Custom Strip”) and calendar years 2027, 2028, 2029, and 2030.

Figure 3: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Forward natural gas prices have experienced extreme volatility, particularly the February 2026 NYMEX contract, which surged from a low of $3.02/MMBtu on January 16 to an intraday-high of $7.83/MMBtu on January 28 – a 259% increase in seven trading days – which is the most rapid increase since natural gas trading began on the NYMEX in April 1990. This surge can be attributed to the restriction of supply from the south due to wellhead freezes, combined with outsized heating and power burn demand for electric heating for nearly two thirds of the US population resulting from Winter Storm Fern.

While the most volatility has been concentrated in the February 2026 contract, the balance of 2026 has also traded markedly higher since January 16. Market participants will be paying close attention to the Energy Information Administration’s natural gas storage reports over the coming weeks in order to evaluate the storage outlook for the rest of the year, which could bring volatility to natural gas forward prices beyond this winter and beyond 2026.

Electricity Market Update

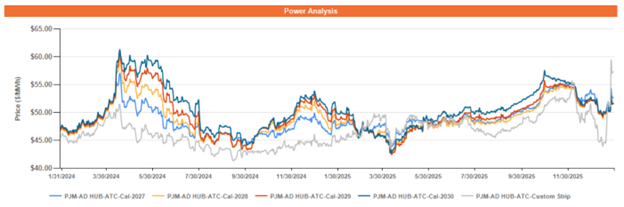

Figure 4 below shows the historical January 30, 2024 – January 30, 2026 ATC forward power prices in dollars per MWh for the balance of 2026 (labeled as “Custom Strip”) and calendar years 2027, 2028, 2029, and 2030 for the AD Hub.

Figure 4: ATC Calendar Year Power Prices for the AD Hub

* Pricing courtesy of Direct Energy Business.

Much like the forward gas market, the forward power market has experienced extreme volatility, mostly concentrated in February 2026 forward prices. Prices for the balance of 2026 are currently trading at a premium compared to outlier years 2027 and beyond and will likely correlate strongly with trends in the forward gas market for the remainder of the winter.

Beyond 2026, forward power prices are trading in a tight range. PJM, its member states, and the FERC, all continue to grapple with the impending supply-demand imbalance resulting from data center growth and the lack of new generation capacity to support it. These ongoing and unresolved challenges bring uncertainty to the market, and forward power prices across the board are trading near multi-year highs as a result.