Ohio Energy Report: June 2025

Peak Loads for Summer 2025

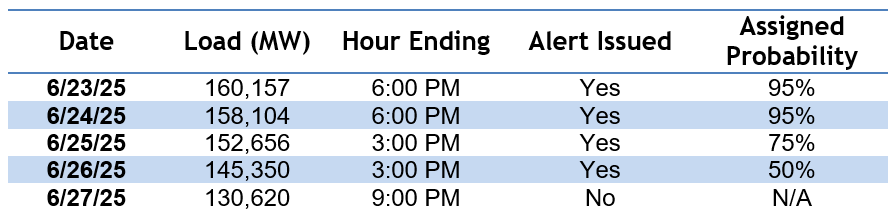

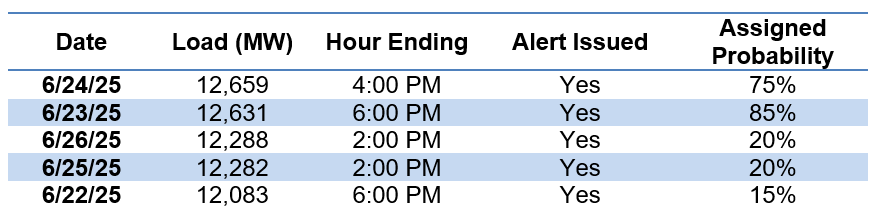

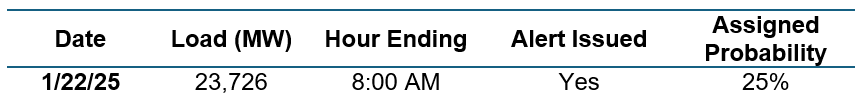

Brakey Energy provides email and text alerts in advance of potential Capacity and Transmission Coincident Peaks (CPs) to clients who elect to receive them. In response to the heat dome that blanketed much of the PJM footprint during the week of June 22–27, Brakey Energy issued four Capacity CP alerts, six FirstEnergy (FE/ATSI Zone) Transmission CP alerts, and two AEP Ohio (AEP) Transmission CP alerts. Five winter CP alerts were also issued for the AEP Zone in January.

Capacity CPs occur during the five one-hour intervals of highest demand on the PJM grid. For Transmission CPs, the five highest one-hour demand intervals on FE’s zonal grid are used, while AEP identifies a single highest one-hour demand interval.

The tables below show PJM’s and FE’s five highest loads, AEP’s highest load, and the date and time of each event based on preliminary data.

Notably, PJM demand exceeded 160,000 megawatts (MW) on June 23 – the highest recorded since 2011.

Table 1: Five Highest Loads for PJM through June 29, 2025

Table 2: Five Highest Loads for FE through June 29, 2025

Table 3: Single Highest Load for AEP through June 29, 2025

In our 2025 Coincident Peak Forecasting Report, we projected PJM’s 1CP and 5CP at 151,751 MW and 146,220 MW, respectively, and FE’s (ATSI Zone) 1CP and 5CP at 12,441 MW and 12,012 MW. The top three PJM and top five ATSI peak loads recorded during the week of June 22 have all met or exceeded these projections. However, with much of the summer still ahead, it remains uncertain how many of these peaks will remain in the top five by season’s end.

We also noted a strong likelihood that the hour ending (HE) 8:00 AM on January 22, 2025, would set the AEP Zone’s 1CP for the November 1, 2024, through October 31, 2025 CP year. While forecasts during the week of June 22 indicated potential to exceed that winter peak, actual metered loads fell short.

AEP’s highest preliminary load during that week occurred during HE 2:00 PM on June 24, reaching 23,344 MW—just 382 MW below the January peak. If PJM had not initiated an emergency demand response event for the AEP Zone from 4:00 PM to 10:00 PM on June 24, the summer peak likely would have surpassed the winter peak.

Brakey Energy will continue monitoring weather and load forecasts and will issue alerts to participating clients as warranted. If you are a Brakey Energy client and would like to receive these alerts, please contact Catherine Nickoson.

PUCO Issues Opinion and Order in Enbridge Base Distribution Rate Case

On June 26, 2025, the Public Utilities Commission of Ohio (PUCO) issued an Opinion and Order (“Order”) in Enbridge Gas Ohio’s (formerly Dominion Energy Ohio) October 2023 base distribution rate case. This decision follows public and evidentiary hearings held between September 2024 and February 2025.

While Enbridge initially sought a $211 million annual revenue increase, the PUCO instead approved a $26.3 million annual revenue decrease and set a 6.60% rate of return (ROR), down from the 7.53% ROR proposed in Enbridge’s original application. We expect this ruling to result in an overall rate decrease for most Enbridge customers once the new rates take effect.

The Order authorizes Enbridge to continue its Pipeline Infrastructure Replacement (PIR) and Capital Expenditure Program (CEP) through 2028, subject to PUCO review. The rate design for the PIR and CEP Riders will change from a fixed monthly or volumetric-based charge (for Daily Transportation Service, or DTS, customers) to a surcharge based on a percentage of base distribution charges. Importantly, the PUCO ordered monthly PIR and CEP caps for DTS customers – an outcome advocated by Matt Brakey in his testimony.

Another favorable outcome for large commercial and industrial customers – also supported by Matt Brakey and the Ohio Energy Leadership Council – is that existing negotiated contracts may remain in place and will not need to be renegotiated. This demonstrates the PUCO’s recognition of the economic value these large users bring to Ohio through job retention and investment.

In response to the Order, Enbridge will need to file updated tariffs and notify customers within 30 days. Natural gas commodity prices are not affected by the Order. If you have questions about how the Order or updated rates may affect you, please contact Katie Emling.

AEP Ohio Files Base Distribution Rate Case

On May 30, 2025, AEP Ohio (AEP) filed a new base distribution rate case with the PUCO. In its application, AEP requests a distribution rate increase, tariff modifications, and approval of certain accounting changes. AEP’s last base rate case was filed in 2020.

Using a test year of December 1, 2024, through November 30, 2025, and a valuation date of December 31, 2024, AEP is seeking a $97.4 million increase in annual revenue, a rate of return (ROR) of 7.64%, and a return on equity of 10.9%. The proposed 5.70% increase in distribution revenue is intended to recover rising costs, maintain system reliability, and provide a fair return to investors.

Key proposals in AEP’s application include:

- Changes to base distribution rates,

- Introduction of a new Data Center Tariff pending the PUCO’s decision in Case No. 24-508-EL-ATA,

- Modifications to five existing riders, including the Distribution Investment Rider (DIR),

- Elimination of four riders, and

- Requests for accounting deferrals for specific expenses, including non-major storm costs

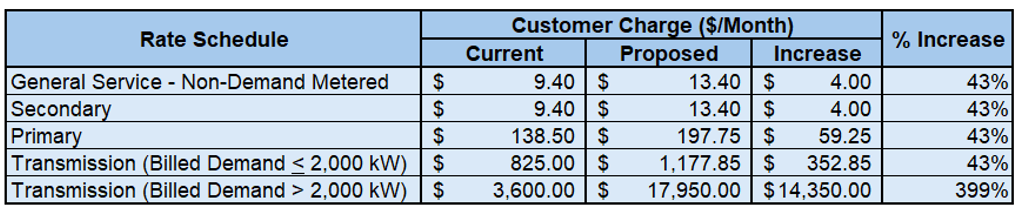

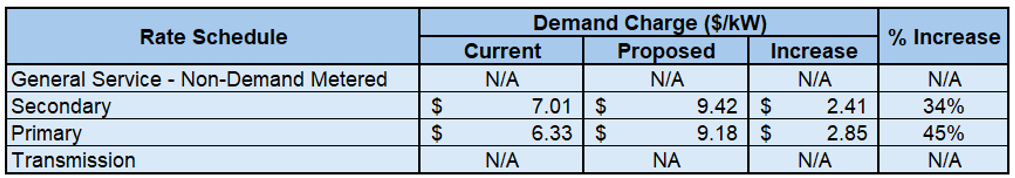

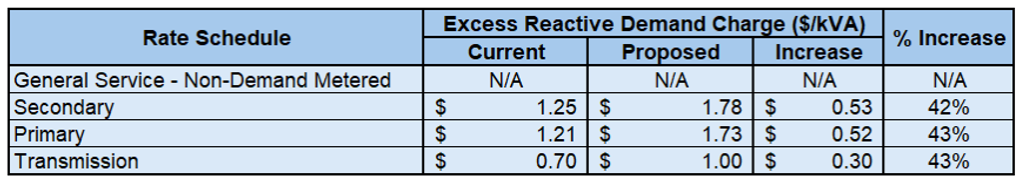

The tables below summarize the current and proposed base distribution rates for non-residential customers. Proposed changes to Residential and General Service – Non-Demand Metered energy charges and Residential monthly customer charges are not included.

Table 4: Current and Proposed Monthly Non-Residential Customer Charges

Table 5: Current and Proposed Demand Charges

Table 6: Current and Proposed Excess Reactive Demand Charges

If you would like more information about AEP’s base rate case or how AEP’s proposed base distribution rates will impact your monthly electric costs, please contact Katie Emling.

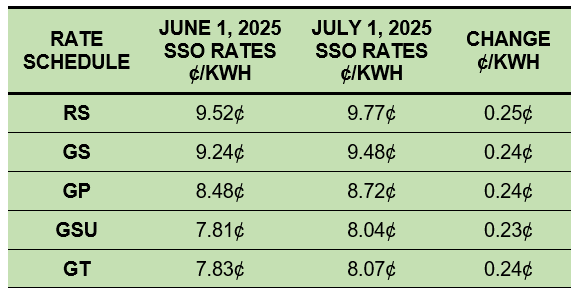

FE Announces Updates to SSO Rates

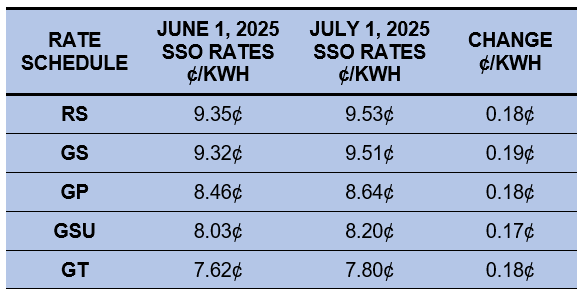

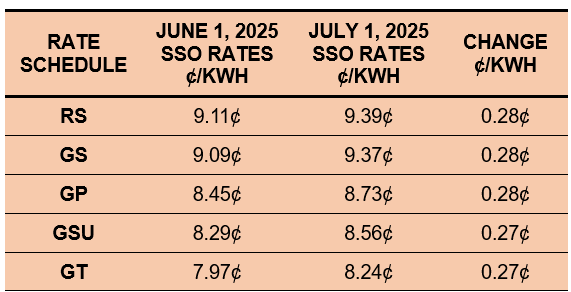

Electric costs will be increasing on July 1 for FE customers that take electric generation service under Ohio Edison’s (OE), the Illuminating Company’s (CEI), and Toledo Edison’s (TE) Standard Service Offer (SSO). The SSO is the default rate charged by the utility for generation services to customers that do not contract with an alternative supplier. FE’s SSO generation rates are higher in the three summer months of June, July, and August than they are in the other nine months of the year.

The tables below compare the current and July 1 SSO rates per kWh for OE, CEI, and TE Residential (RS), Secondary (GS), Primary (GP), Subtransmission (GSU), and Transmission (GT) rate schedules. These rates will change again on September 1.

Table 7: OE SSO Rates

Table 8: CEI SSO Rates

Table 9: TE SSO Rates

SSO rates are slightly higher than they were one year ago for RS and GS customers of OE and TE. For other SSO customers, they are slightly lower than they were one year ago, but they still remain enough above market that virtually all customers should be competitively sourcing power. If you would like more information about how FE’s recent SSO rate updates will impact your monthly electric costs, please contact Katie Emling.

Residential Corner

The sky-high Base Residual Auction (BRA) clearing price has resulted in all offers being materially higher than what customers are accustomed to. Users looking to hide on a low short-term rate can contract with American Power & Gas for three months at an artificially low 5.59¢ per kWh. Just know that this is a teaser rate and be sure to enter into a new contract before expiration to avoid a sky-high holdover provision!

For those who have been under American Power & Gas for a teaser rate in the last year, they probably will not let you sign up for that promotional offer. In that case, Major Energy is offering a similar three-month offer for 6.19¢ per kWh.

The best longer term option is a 8.29¢ 12-month offer from Energy Harbor. These types of high prices are going to be a shock to residential customers, but there is no getting around this surge in capacity prices.

Regarding natural gas, Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide a termination notice to your existing supplier and you will automatically be defaulted to the SCO.

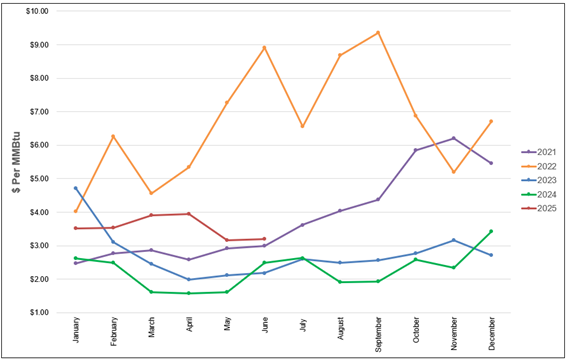

Natural Gas Market Update

The NYMEX price for June settled at $3.204 per Million British Thermal Units (MMBtu) on May 28, 2025. This price is up 1.1% from the May 2025 price of $3.170 per MMBtu. This settlement price is used to calculate June gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2021, 2022, 2023, 2024, and 2025 year-to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

Figure 2 below shows the historical June 30, 2023 through June 30, 2025 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2025 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, and 2029.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Forward gas prices, particularly in 2026, have been on the rise overall since February. Gas storage levels are now at their normal seasonal levels, after having been in a deficit to the trailing 5-year average in February, thanks to strong production and mild spring weather.

However, market participants worry that a hot summer could cause high power burn demand for gas, and this worry combined with rising LNG exports and geopolitical tensions in the Middle East has further contributed to the rise in forward gas prices over the past 90 days.

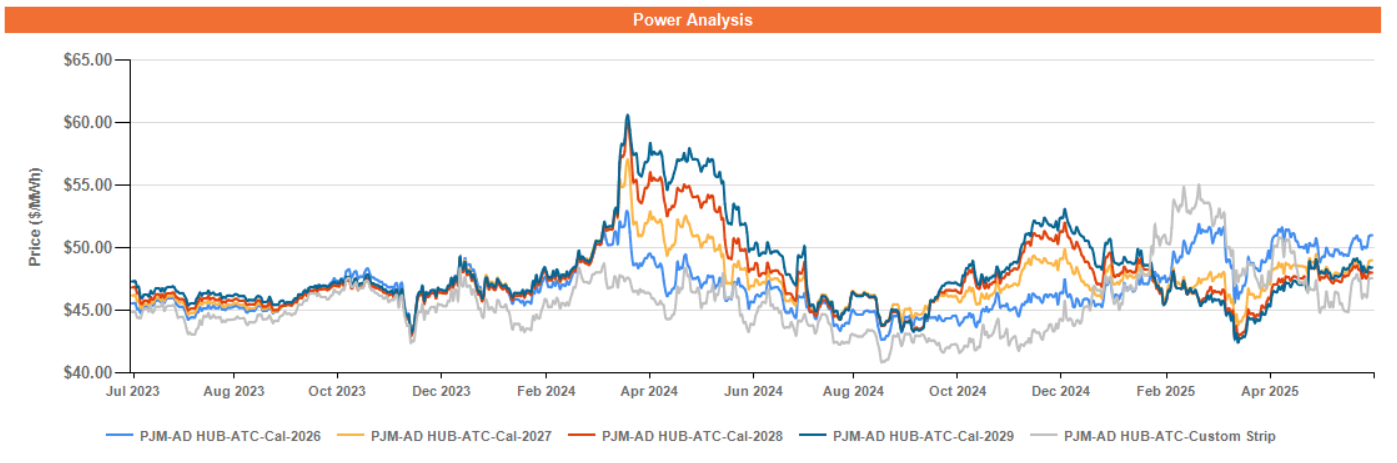

Electricity Market Update

Figure 3 below shows the historical June 30, 2023 through June 30, 2025 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2025 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, and 2029 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

*Pricing courtesy of Direct Energy Business.

Forward power prices continue to strongly correlate with forward gas prices in a state of backwardation. Prices in 2026 have maintained a premium over outlier years, largely due to trends in the gas market. Gas production and storage numbers will be closely watched as we progress through the summer – strong production and storage injections could soften prices, while stagnant or falling production and weak storage injections could bolster prices.

Outlier years in which capacity rates are partially unknown might break away from trends in the gas market after the next BRA capacity auction is held next month. The capacity price collar of $175-$325 per MW-day has been put in place until May 31, 2028, but market participants will nonetheless be keen to see the outcome of the auction and evaluate the impact on electricity prices in the future.