Ohio Energy Report: April 2023

Residential Corner

Electricity

In an Ohio Energy Report first, we are leading with our Residential Corner section. With Standard Service Offer (SSO) rates skyrocketing in June, it is imperative that you, your family, friends, and neighbors execute supply agreements with Certified Retail Electric Service suppliers.

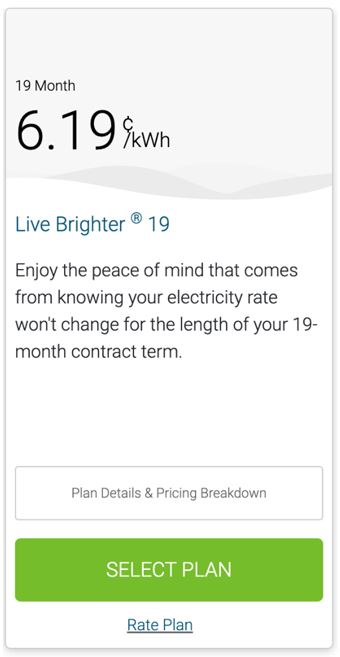

Direct Energy (DE) is currently offering a competitive 6.19¢/kilowatt-hour (kWh) 19-month offer. Compare this to the SSO, which will be near 12¢/kWh come June 2023 for FirstEnergy (FE) and AEP-Ohio service territories. This offer may vary based on electric distribution utility.

Figure 1: DE 19-Month Offer

You can find many supplier offers on the Public Utilities Commission of Ohio’s (PUCO) Apples-to-Apples page that are at lower rates. However, nearly all of these offers either include monthly fees or are for significantly shorter terms. Power prices are relatively low in the short term and move significantly higher in the intermediate to longer term. In our opinion, this DE offer represents that most compelling value given the current state of the wholesale power market.

Best of all, because there are no monthly or early termination fees, if power prices were to significantly collapse, you could always enter into a new agreement. In the event prices stay stagnant or trend higher, you will be price protected for close to two years.

Natural Gas

Regarding natural gas, to the extent you entered into a fixed-price residential natural gas contract that does not include an early termination fee, including the residential offers Brakey Energy highlighted prior to this past winter, you should seek to exit and either enter into a new agreement or default to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to employ this strategy if they are comfortable riding the highly volatile natural gas market – especially through the fall. To employ this strategy, you simply need to provide termination notice to your existing supplier and you will automatically be defaulted to the SCO.

FirstEnergy Files ESP V Application with the PUCO

On April 5, 2023, FE filed its fifth Electric Security Plan (ESP V). This ESP would start on June 1, 2024 after FE’s current ESP expires and would continue through May 31, 2032.

At the center of the ESP V application is FE’s proposal to maintain its Competitive Bidding Process (CBP) to secure load for Standard Service Offer (SSO) customers. FE plans to implement modifications to the CBP process through ESP V in order to increase supplier participation in SSO auctions, while also reducing risk premiums and minimizing risk of supplier default.

Also included in the ESP V application are plans to maintain, eliminate, or modify existing distribution and cost recovery riders. One such rider that will be maintained under its current terms and conditions is the Delivery Capital Recovery Rider (“Rider DCR”). Rider DCR supports system reliability by facilitating capital investment in FE’s delivery systems.

FE’s Nonmarket Based Services Rider (“Rider NMB”) Pilot, also known as the “transmission pilot program,” would be eliminated during the term of ESP V, but FE proposes to add a successor billing structure in its place. The Rider NMB Pilot program currently permits eligible customers to opt out of paying the standard Rider NMB rate and instead pay for transmission service based on how they use power during the ATSI Zone’s five highest coincident peaks, also known as their Network Service Peak Loads (NSPL).

FE’s elimination of the Rider NMB Pilot by April 1, 2025 would be accompanied by a modification to the Rider NMB rate design. A new second rate, the NMB 2, would apply to all commercial and industrial customers that have interval or advanced meters for transmission charges based on their NSPL. The current Rider NMB charges, renamed NMB1, will apply to commercial and industrial customers that do not have interval or advanced meters, in addition to residential and lighting customers. NMB 1 charges would be based on monthly billed demand or consumption, similar to how these customers are being billed currently.

In ESP V, FE is also proposing to introduce three new riders, namely the Storm Cost Recovery Rider, the Vegetation Management Cost Recovery Rider, and the Energy Efficiency Cost Recovery Rider (“Rider EEC”). Rider EEC would fund a new portfolio of cost-effective energy efficiency and demand response programs, but will not be applicable to customers that choose to opt out of FE’s proposed energy efficiency programs.

FE also proposes to continue but modify its Economic Load Response Program Rider (“Rider ELR”) to encourage customers to participate directly in PJM Capacity Market Demand Response programs through a curtailment service provider. In addition to requiring Economic Load Response (ELR) customers to register their load with PJM instead of FE, ESP V proposes to scale down credits to participating customers by $0.50 each delivery year (DY) beginning June 1, 2025.

If you have any questions about FE’s ESP V as filed with the PUCO, please contact Katie Emling.

FE and AES Ohio Complete SSO Auctions for 2023/2024 DY

On March 20, 2023, FE held its final SSO auction for the 2023/2024 DY. The auction secured the remaining 34% of FE’s SSO load for the DY and cleared at a price of 8.38¢ per kWh. This is approximately 14% lower than the average clearing price from FE’s second SSO auction held in January 2023 that secured 33% of their load for the 2023/2024 DY. FE’s average weighted SSO auction price for the 2023/2024 DY is 10.13¢ kWh, which is approximately 89% higher than FE’s average weighted SSO auction price for the current 2022/2023 DY.

AES Ohio also held its final SSO auctions for the 2023/2024 DY earlier this month. The auctions took place on April 4, 2023 and secured 25% of AES Ohio’s expected SSO load through a 12-month product and 40% of their SSO load through a 24-month product. The auctions cleared at prices of 8.32¢ per kWh and 9.01¢ per kWh, respectively. Those prices are approximately 21-27% lower than the average clearing price from AES Ohio’s first auction held in November 2022. Overall, AES Ohio’s average weighted price for 2023/2024 DY is 9.66¢ per kWh, which is approximately 2% lower than AES Ohio’s average weighted SSO auction price for the current 2022/2023 DY. Due to the timing of AES Ohio’s auctions for the current DY, current SSO pricing for AES Ohio customers has already been elevated in comparison to SSO pricing for FE and AEP customers.

We will report on updated SSO rates expected to increase on June 1, 2023 across Ohio’s electric distribution utilities (EDU) in future newsletters. If you have any questions about the SSO auction process or about SSO rates for any of Ohio’s EDUs, please contact Katie Emling.

New Transmission Rates in Effect for FE and AEP Customers as of April 1, 2023

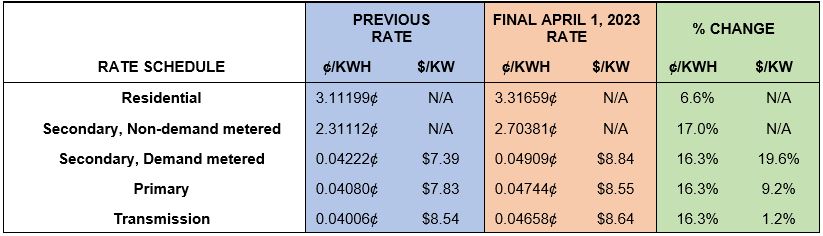

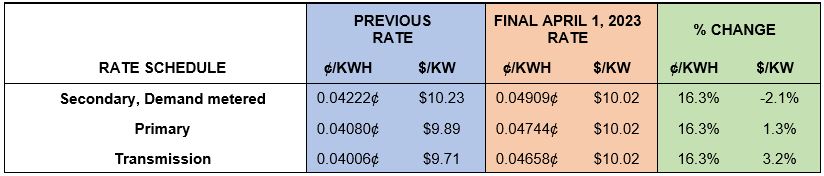

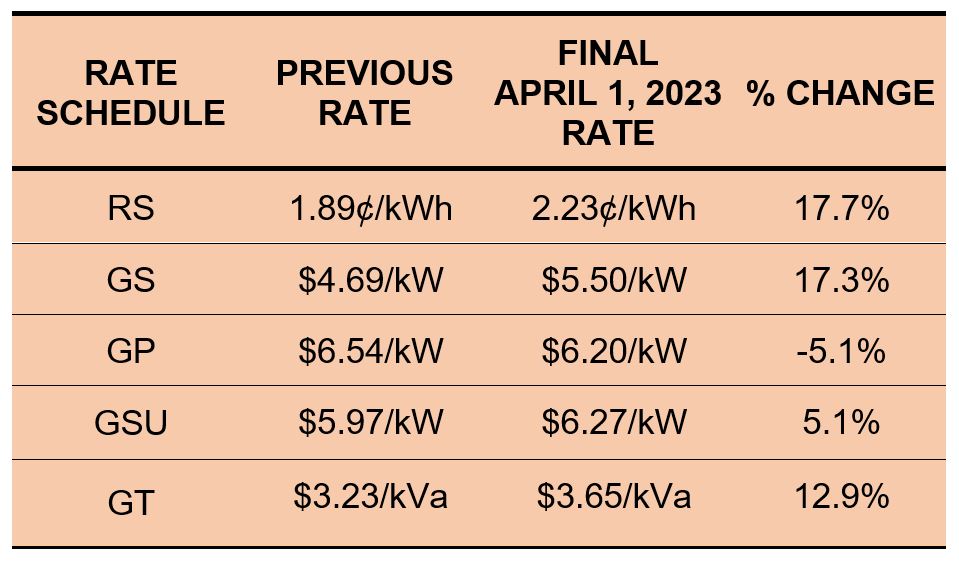

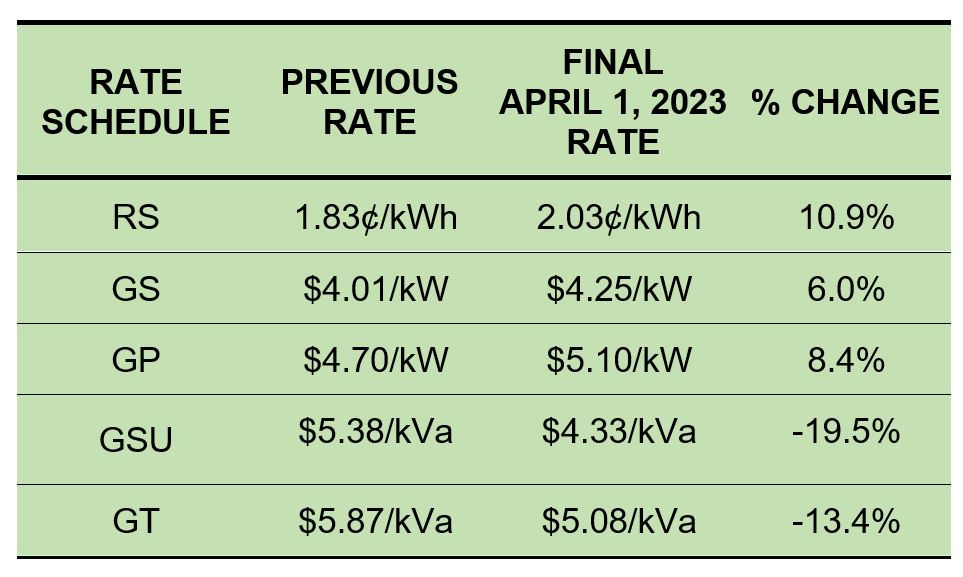

On March 23, 2023, AEP filed final updated rates to its Basic Transmission Cost Recovery (BTCR) rider that went into effect on April 1. The tables below show the previous and April 1, 2023 BTCR rates for non-transmission pilot program customers and transmission pilot program customers of AEP Ohio. The BTCR rider has both kWh consumption and kW demand components.

Table 1: Previous and Final April 1, 2023 BTCR Rates for AEP Ohio Customers

Table 2: Previous and Final April 1, 2023 for AEP Ohio Customers Participating in the Transmission Pilot Program

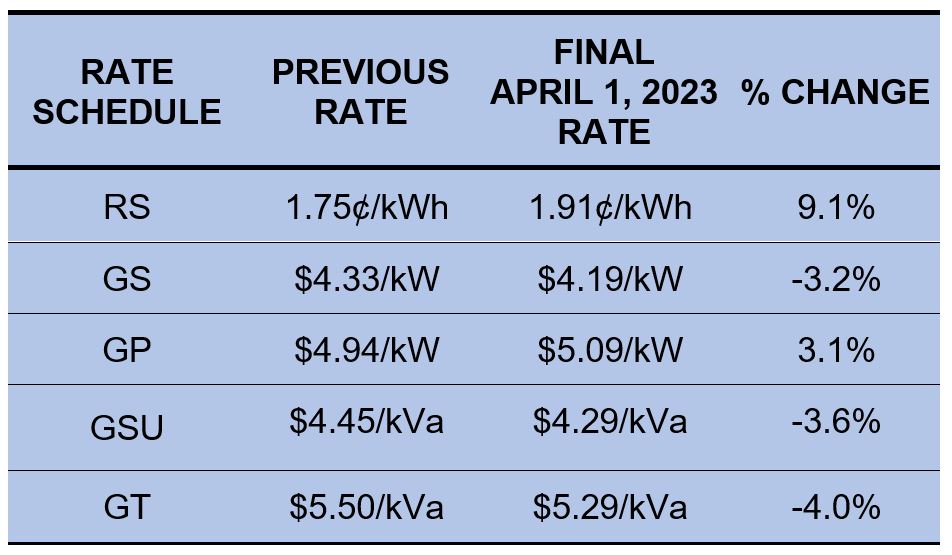

On March 30, 2023, FE also filed final April 1 updated rates to its Rider NMB for all three Ohio operating companies: Ohio Edison (OE), The Illuminating Company (CEI), and Toledo Edison (TE). Previous and April 1, 2023 Ridder NMB rates for OE, CEI, and TE Residential (RS), Secondary (GS), Primary (GP), Subtransmission (GSU), and Transmission (GT) rate schedules are shown in the tables below. Rates are per kWh for RS customers and per kW or kilovolt-ampere (kVa) for GS, GP, GSU, and GT customers. Customers that are participating in FE’s transmission pilot program are opted out of paying the NMB rider.

Table 3: OE Rider NMB Rates

Table 4: CEI Rider NMB Rates

Table 5: TE Rider NMB Rates

If you have any questions about how the new BTCR and NMB rates will impact your electric costs, please contact Katie Emling.

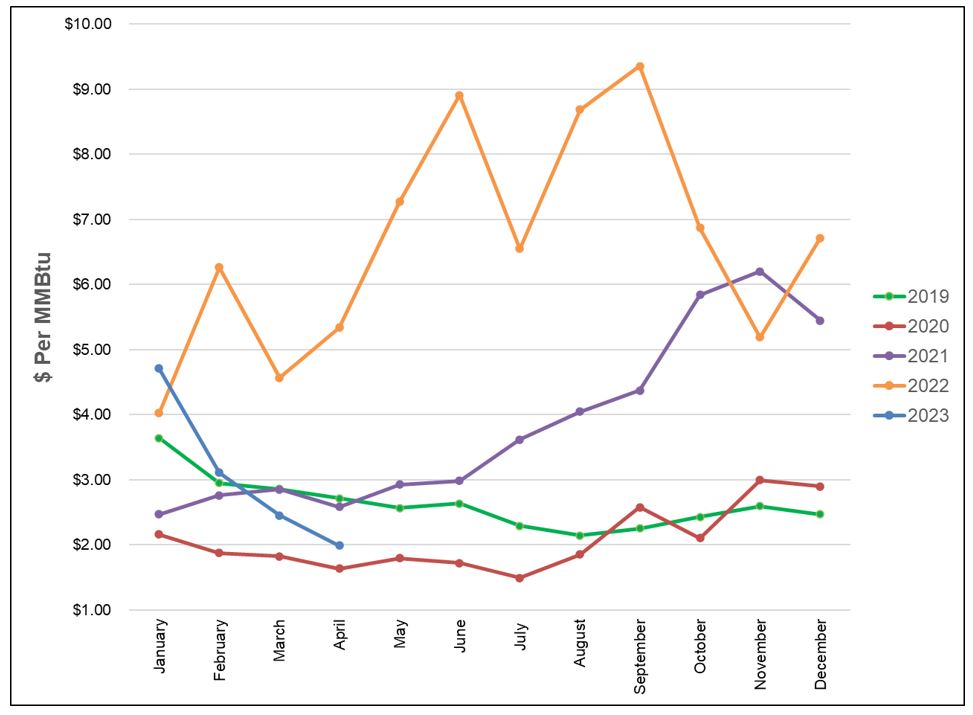

Natural Gas Market Update

The NYMEX price for April settled at $1.991 per Million British Thermal Units (MMBtu) on March 29, 2023. This price is down 18.8% from March’s price of $2.451 per MMBtu. This settlement price is used to calculate April gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2019, 2020, 2021, 2022, and 2023 to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 2: NYMEX Monthly Natural Gas Settlement Prices

Figure 3 below shows the historical April 26, 2021 through April 26, 2023 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2023 (labeled “Custom Strip” in the graph below) and calendar years 2024, 2025, 2026, 2027, and 2028. Natural gas prices for the balance of 2023 and calendar year 2024 continue to trade at lower levels compared to outlier years, reflecting a state of contango in the market after a long period of backwardation. Forward prices for natural gas in calendar years 2025 through 2028 are trading at very similar levels..

Figure 3: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business

Electricity Market Update

Figure 4 below shows the historical April 26, 2021 through April 26, 2023 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2023 (labeled “Custom Strip” in the graph below) and calendar years 2024, 2025, 2026, 2027, and 2028 for the AD Hub. Like gas, the power market finds itself in a state of contango. Forward power prices have been oscillating up and down in recent weeks with an overall upward trend.

Figure 4: ATC Calendar Year Power Prices for the AD Hub

*Pricing courtesy of Direct Energy Business.