Ohio Energy Report: April 2025

Transmission Costs Changing for AES Ohio Customers

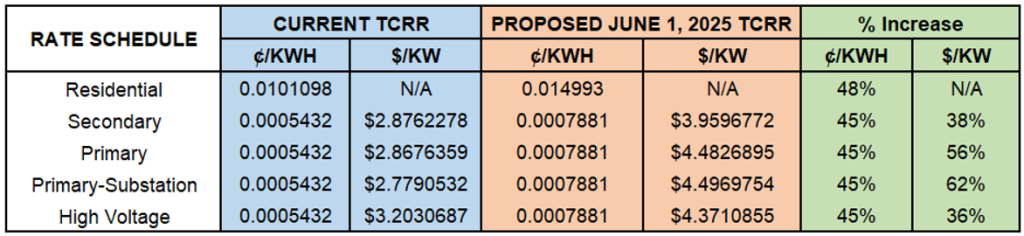

AES Ohio recently filed its proposed June 1, 2025, rate updates for the Transmission Cost Recovery Rider (TCRR). The TCRR includes both kilowatt-hour (kWh) consumption and kilowatt (kW) demand components. Beginning June 1, the demand component for AES Ohio non-residential customers served at or above primary voltage will be billed based on the customer’s Network Service Peak Load (NSPL) for transmission. Secondary voltage customers will continue to be billed based on their monthly billed demand unless they opt into NSPL-based billing.

According to the filing, the energy (kWh) component of the TCRR will increase by 45% for AES Ohio non-residential customers. The demand (kW) component will also increase, with the extent of the increase varying by rate schedule. Customers served under the Primary and Primary-Substation rate schedules will experience the largest increases, as AES Ohio is proposing to raise kW-based TCRR rates to approximately $4.50 per kW.

The table below shows the current and proposed TCRR rates effective June 1, 2025, for AES Ohio customers.

Table 1: Current and Proposed June 1, 2025 TCRR Rates for AES Ohio

If you are an AES Ohio customer and would like more information about how the TCRR impacts your monthly electric costs, please contact Katie Emling.

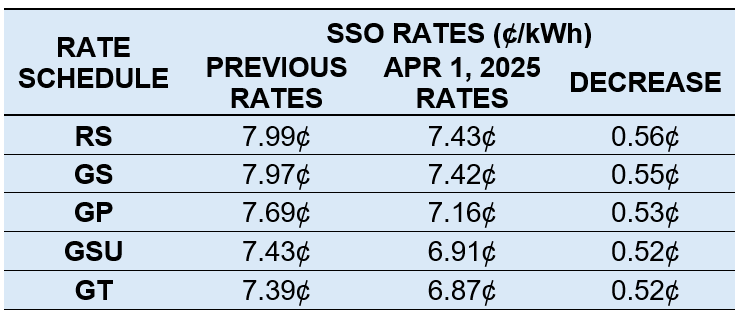

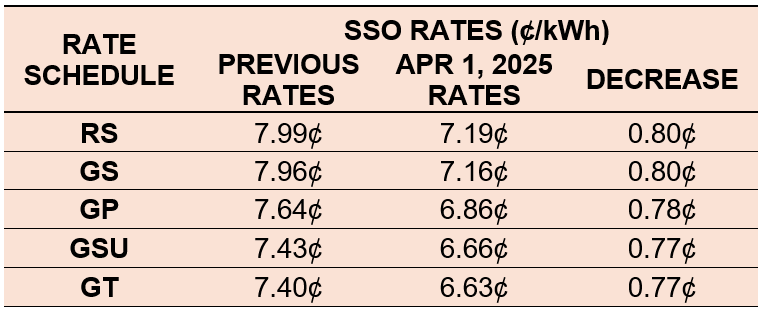

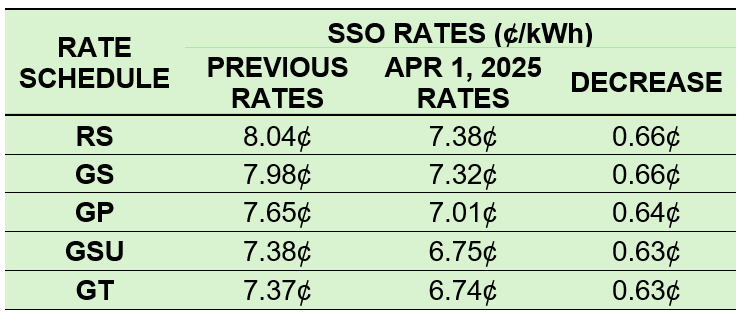

FirstEnergy SSO Rates Updated April 1

On April 1, 2025, electric generation costs decreased by approximately 0.65¢ per kilowatt-hour (kWh), on average, for FirstEnergy’s (FE) Ohio customers receiving electric generation service under the utilities’ Standard Service Offer (SSO). The SSO is the default rate charged by the utility for generation and ancillary services to customers who do not contract with an alternative supplier. The SSO generation rate is higher during the summer months of June, July, and August than during the remaining nine months of the year.

The previous and April 1 SSO per-kWh rates for Ohio Edison (OE), the Illuminating Company (CEI), and Toledo Edison (TE) under the Residential (RS), Secondary (GS), Primary (GP), Subtransmission (GSU), and Transmission (GT) rate schedules are shown in the tables below. These rates are expected to increase on June 1, 2025.

Table 2: OE SSO Rates

Table 3: CEI SSO Rates

Table 4: TE SSO Rates

If you are defaulting to FE’s SSO and would like more information about how FE’s SSO rate updates will impact your monthly electric costs, please contact Katie Emling.

Residential Corner

The sky-high Base Residual Auction (BRA) clearing price has resulted in all offers extending beyond June 2025 to be materially higher than what customers are accustomed to. Users looking to hide on a low short-term rate can contract with American Power & Gas for three months at an artificially low 4.59¢ per kWh. Just know that this is a teaser rate and be sure to enter into a new contract before expiration to avoid a sky-high holdover provision!

The best longer term option is a 7.69¢ six-month offer from Energy Harbor. These types of high prices are going to be a shock to residential customers, but there is no getting around this surge in capacity prices.

Regarding natural gas, Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide a termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

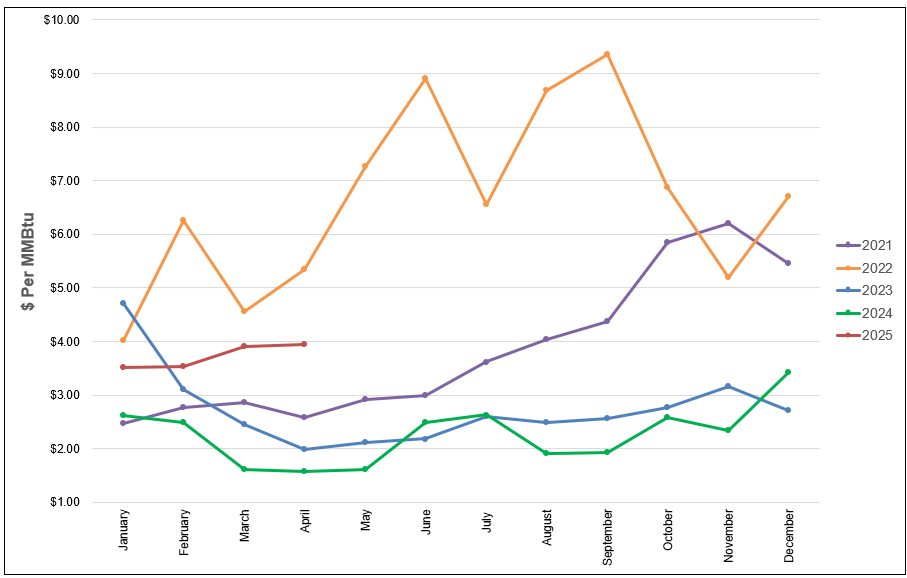

The NYMEX price for April settled at $3.950 per Million British Thermal Units (MMBtu) on March 27, 2025. This price is up just 1.1% from the March 2025 price of $3.906 per MMBtu. This settlement price is used to calculate April gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2021, 2022, 2023, 2024, and 2025 year to date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

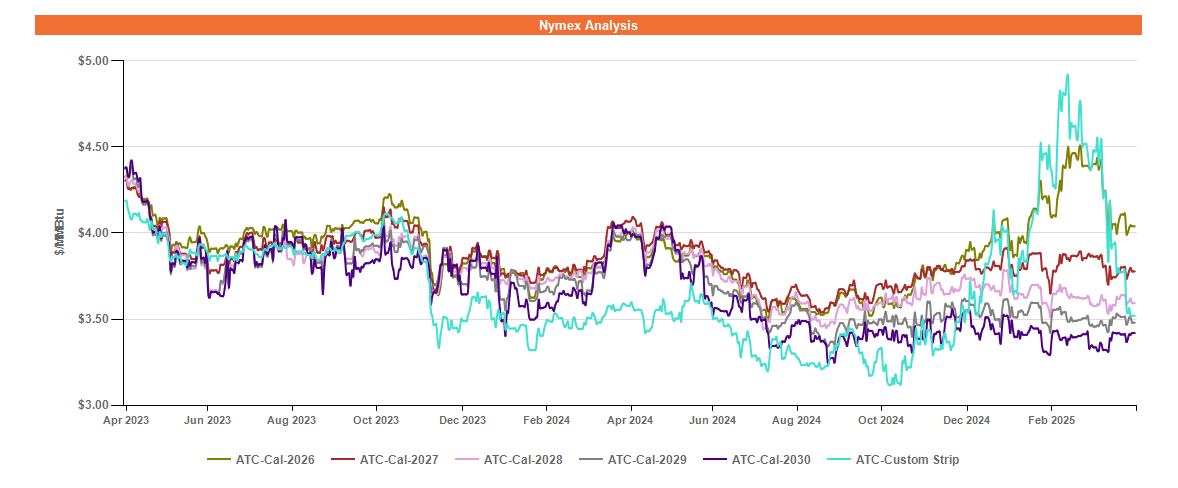

Figure 2 below shows the historical April 29, 2023 through April 29, 2025 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2025 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, 2029, and 2030.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

In the time since our previous newsletter, forward natural gas prices for the balance of 2025 through 2026 have softened significantly. This softness can largely be attributed to market participants’ reaction to the Trump administration’s 90-day pause on proposed tariffs for many countries, record-setting domestic gas production (eclipsing 108 BCF per day recently), and softening Liquefied Natural Gas (LNG) demand from China as a result of China-USA tariff retaliations.

The strong gas production and moderate weather we have experienced in recent weeks resulted in earlier-than-expected injections into storage in March, a rare occurrence. Currently, gas storage levels sit just 2.2% below the trailing 5-year average, but this deficit was as wide as nearly 15% in early March, when forward gas prices through 2026 reached new 5-year highs.

Outlier years have been mostly flat month over month, with the state of backwardation still intact. Market participants continue to price in the potential for a global LNG export capacity glut in these years, which could keep more gas available domestically and put downward pressure on domestic gas prices.

Electricity Market Update

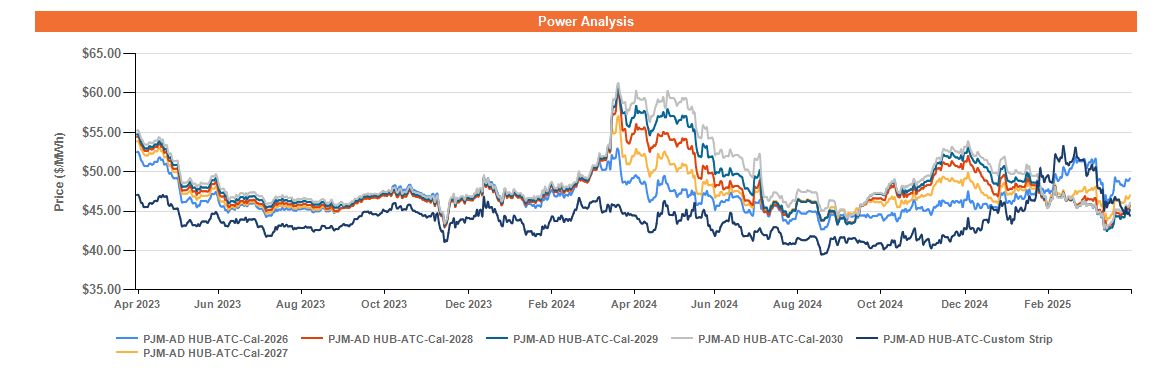

Figure 3 below shows the historical April 29, 2023 – April 29, 2025 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2025 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, 2029, and 2030 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

* Pricing courtesy of Direct Energy Business.

Price action in the forward power market has continued to closely mirror that of the gas market over the past month. Forward prices for the balance of 2025 have softened significantly since our previous newsletter – at that time, the balance of 2025 was the most expensive forward power in the market, but prices in that timeframe have since softened markedly to become one of the lowest-priced forward power in the market.

The Federal Energy Regulatory Commission recently approved the proposed “Capacity Collar” for the next three BRA Capacity Auctions, in which a cap of $325/MW-day and a floor of $175/MW-day will be implemented. The collar could help lower volatility in forward power prices through May 2028, as the collar was approved only for the BRA Capacity Auctions for the 2026/2027 and 2027/2028 delivery years. In the meantime, forward power prices in these outlier years continue to trade below 2026, creating a backwardated market reflective of current forward gas market conditions.