Ohio Energy Report: December 2025

PJM Releases 2027/2028 Delivery Year BRA Results

On December 17, 2025, PJM Interconnection announced the results of its Planning Year 2027/2028 Base Residual Auction (BRA). The auction procured 134,478.1 megawatts (MW) of unforced capacity from generation resources and demand response across the Regional Transmission Organization (RTO).

The auction cleared at $333.44 per MW-day for the entire PJM region, which includes the ATSI, AEP, DAY, and DEOK transmission zones. This price matched the Federal Energy Regulatory Commission’s (FERC) approved capacity price ceiling and represents a 1.3% increase compared to the prior auction for the 2026/2027 Delivery Year (DY).

The 2027/2028 DY is the second and final year in which a FERC-approved capacity price collar is in effect. Without the capacity ceiling in place, PJM’s simulations (based on the existing offers in the auction) would have resulted in an RTO-wide clearing price of approximately $542.83/MW-day, which is $196.36/MW-day or 58.9% above the ceiling-limited clearing price. It’s important to note that PJM doesn’t know how actual offers would have changed if the price collar was not in effect.

In its press release announcing the auction results, PJM stated that the capacity secured through the BRA, combined with Fixed Resource Requirement resources, falls short of PJM’s reliability requirement by 6,623 MW. In practical terms, the committed supply does not meet PJM’s long-standing reliability standard, which is designed to maintain a reserve margin sufficient to withstand a one-in-ten-year extreme weather or system event.

PJM Executive Vice President Stu Bresler underscored the challenge, noting that electricity demand – particularly from data centers – continues to grow faster than new supply additions. He emphasized that addressing this imbalance will require coordinated action among PJM, market participants, policymakers, and large load customers.

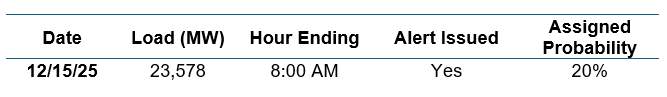

AEP Zone Load Registers Within Historical 1CP Range on December 15

Brakey Energy provides email and text alerts in advance of loads having the potential to set the year’s American Electric Power (AEP) Zone Transmission Coincident Peak (CP, or 1CP) to clients enrolled in AEP’s Basic Transmission Cost Rider (BTCR) transmission pilot program. On December 15, 2025 an arctic blast swept across the Great Lakes, sending much of the AEP Zone into subzero temperatures with the wind chill. As a result, Brakey Energy issued a CP alert for the morning of December 15.

As shown in the table below, the preliminary metered load on December 15 holds the highest peak load to date in the AEP Zone since the current CP year began on November 1, 2025.

Table 1: Single Highest Load for AEP Zone through December 21, 2025

The PJM Regional Transmission Organization predicted that AEP’s peak load this winter would reach 24,776 MW. For context, AEP’s 1CP for the previous period (2024/2025) was 23,726 MW, only 148 MW higher than the metered load on December 15.

Even though the load on December 15 is within 1% of the AEP Zone’s previous 1CP, we believe that, in the wake of new data center load coming online across the transmission zone over the past year, it is probable that the load registered on December 15 will be displaced by later this winter or this coming summer.

Brakey Energy will continue to monitor weather and load forecasts and will issue alerts to participating clients when warranted.

PUCO Orders FirstEnergy to Pay Over $250 Million in Restitution, Refunds, and Forfeitures

On November 19, 2025, the Public Utilities Commission of Ohio (PUCO) issued orders concluding its investigation related to the federal criminal probe into the passage of House Bill 6. In two orders, the Commission found FirstEnergy’s (FE) Ohio utilities – Ohio Edison (OE), The Illuminating Company (CEI), and Toledo Edison (TE) – violated Ohio law, PUCO rules, and prior Commission orders.

The PUCO ordered the utilities to pay $250.7 million in combined customer restitution, refunds, and civil forfeitures. Of that amount, FE was ordered to pay $64.1 million in civil forfeitures to the State of Ohio’s General Reserve Fund. These forfeitures were imposed by the Commission for violations of corporate separation requirements, disclosure failures in prior PUCO proceedings, and deficiencies identified in a 2021 audit. PUCO cited a pattern of inadequate separation between regulated utilities and unregulated affiliates that contributed to the HB 6 scandal.

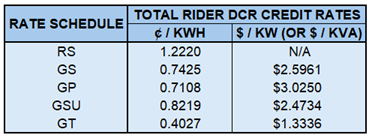

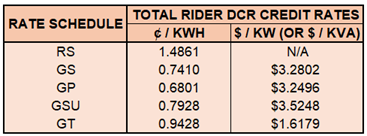

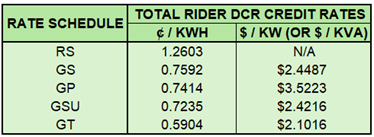

The remaining $186.6 million will be paid as restitution to customers over three billing cycles, including treble damages tied to HB 6-related expenditures and additional amounts identified through a PUCO audit. These credits will flow through to customers through the Delivery Capital Recovery Rider (Rider DCR) and the Demand Side Management and Energy Efficiency Rider 2 (Rider DSE2) – Part 2 for customers who did not previously opt-out of paying Rider DSE charges. These distribution credits will appear on customers’ bills for the three billing cycles ending in January, February, and March 2026.

The tables below summarize the rather significant Rider DCR credits that will be returned to customers served under OE, CEI, and TE Residential (RS), Secondary (GS), Primary (GP), Subtransmission (GSU), and Transmission (GT) rate schedules. Rider DCR credits on a per kWh basis will also be issued to OE, CEI, and TE customers billed under the companies’ three lighting tariffs.

Table 2. Rider DCR Credit Rates for OE Customers

Table 3. Rider DCR Credit Rates for CEI Customers

Table 4. Rider DCR Credit Rates for TE Customers

FirstEnergy Files Updated Rates for January 1 Based on PUCO’s Ruling

On November 26, 2025 following the PUCO’s Opinion and Order in FE’s May 2024 base rate case, FE filed distribution rate updates with an effective date of January 1, 2026. The filed rates were based on the annual revenue requirement approved by the Commission in the case, which is an increase of $34 million in the aggregate for FE’s three operating companies. On a company specific basis, OE was ordered to lower its annual revenues by $17.4 million, TE was ordered to lower its annual revenues by $24.4 million, and CEI was approved to increase its annual revenues by $75.9 million.

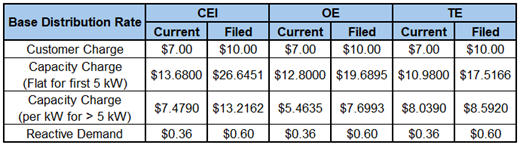

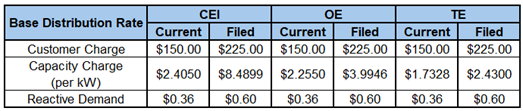

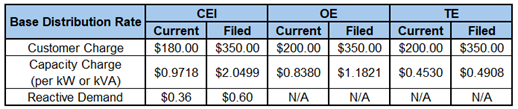

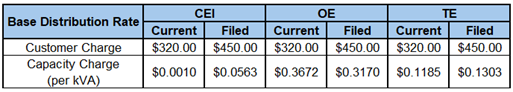

The tables below summarize the current and filed base distribution rates for FE GS, GP, GSU, and GT customers. Subject to PUCO approval, the rates summarized below would go into effect. However, if requests for rehearing should be filed by intervening parties in the case (deadline of December 19) and a rehearing is granted, we would expect the implementation of these rates to be delayed as the rehearing takes place.

Table 5. Rate Changes for FE GS Customers

Table 6. Rate Changes for FE GP Customers

Table 7. Rate Changes for FE GSU Customers

Table 8. Rate Changes for FE GT Customers

Although base distribution rates have increased across the board for all customers, these increases are coupled with rate changes, mostly decreases, to five distribution related riders. These riders include the Tax Savings Adjustment Rider, the Distribution Uncollectible Rider, Advanced Metering Infrastructure / Modern Grid Rider, PIPP Uncollectible Rider, and Rider DCR. A new distribution rider called the Customer Credit Recovery Rider was also established in this case.

If you have questions about how these expected rate changes may affect your business, please contact Katie Emling.

Residential Corner

Sky-high Base Residual Auction (BRA) clearing prices have resulted in sustained elevated generation offers. Elevated winter power prices only makes this problem worse.

We recommend customers with an approaching contract expiration migrate to a short-term six-month offer with Energy Harbor for 8.69¢/kWh.

Regarding natural gas, Brakey Energy has long found defaulting to distribution utilities’ Standard Choice Offer a prudent strategy for natural gas supply. However, Columbia Gas of Ohio (“Columbia”) rates have recently jumped. For Columbia customers, and for any customer wanting price certainty this winter, Energy Harbor is currently offering a six-month deal for $0.5890/ccf.

Natural Gas Market Update

The NYMEX price for December settled at $4.424 per Million British Thermal Units (MMBtu) on November 26, 2025. This price is up 31% from the November 2025 price of $3.376 per MMBtu. This settlement price is used to calculate December gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2021, 2022, 2023, 2024, and 2025. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

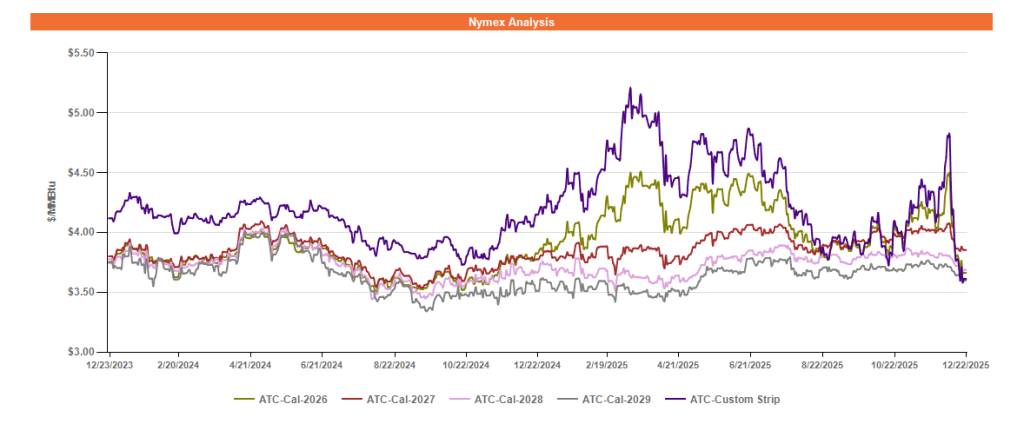

Figure 2 below shows the historical December 22, 2023 through December 22, 2025 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the first quarter of 2026 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, and 2029.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

The forward gas market has experienced significant volatility in the month of December, with the January 2026 NYMEX contract alone swinging between a high on December 5 of $5.50/MMBtu and a low of $3.84/MMBtu on December 16 – a 30% swing. This volatility, particularly in the short term, is attributed to fast-changing weather forecasts and near-record production levels.

Outlier years in 2027 and beyond continue to trade mostly flat, and the overall state of contango has remained intact. Market participants continue to price in the possibility of a global LNG supply glut in outlier years, resulting in more gas availability domestically and depressing forward prices.

Electricity Market Update

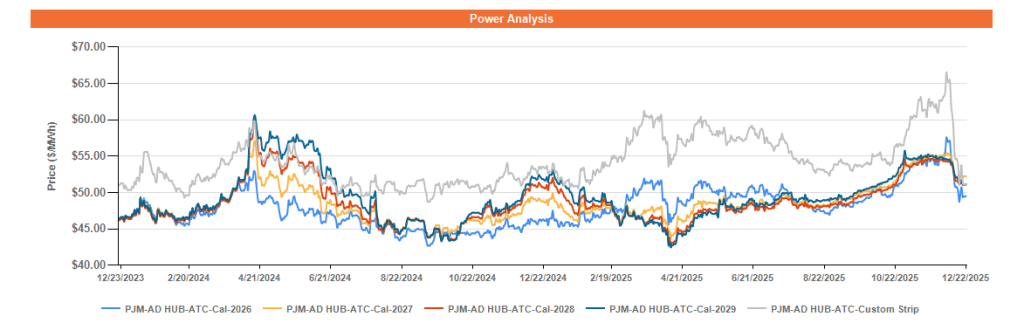

Figure 3 below shows the historical December 22, 2023 through December 22, 2025 ATC forward power prices in dollars per Megawatt hour (MWh) for the first quarter of 2026 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, and 2029 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

* Pricing courtesy of Direct Energy Business.

The forward power market has also experienced increased volatility in recent weeks. While forward power prices in the short term through 2026 have correlated with trends in the gas market, outlier years in 2027 and beyond have also experienced volatility, unlike the gas market.

The volatility in outlier years can be attributed to the increasing presence of data centers and their future load forecasts, combined with PJM’s projected potential shortfalls in generation capacity. As stakeholders work to develop resolutions to this supply-demand imbalance, the forward power market is likely to remain volatile.