Ohio Energy Report: June 2023

Matt Brakey Files Testimony in AEP ESP V Case on Behalf of OELC

On June 9, 2023, Regulatory Counsel for the Ohio Energy Leadership Council (OELC) submitted the direct testimony of Matt Brakey in AEP Ohio’s Fifth Electric Security Plan (ESP V) case before the Public Utilities Commission of Ohio (PUCO). In his testimony, Matt voices support for (1) the continuation of AEP Ohio’s Basic Transmission Cost Rider (BTCR) Pilot Program with annual cap increases, and (2) the continuation of AEP Ohio’s interruptible programs with modifications to AEP Ohio’s proposal.

Matt further proposes cap increases for the Interruptible Power Rider – Expanded (IRP-E) and opposes the reduction of the Interruptible Power Rider – Legacy (IRP-L) credits. In addition to discussing the BTCR Pilot Program and the IRP-E and IRP-L programs, Matt highlights the large bill impacts of the proposed Distribution Investment Rider (DIR), particularly to General Service customers who receive service at Secondary and Primary voltage levels.

Settlement meetings between AEP Ohio and intervening parties commenced at the PUCO during the week of June 12. In order to give all parties more time to determine if a settlement in the case can be reached, the PUCO filed a motion for continuance of the hearing in the case that was originally scheduled for July 10. The proposed date for the hearing is August 15. The motion also extends the filing deadline for PUCO Staff testimony in the case to July 28. A pre-hearing conference was held at the PUCO on June 22.

FERC Approves PJM’s Proposal to Delay BRA and IA Auctions for 2025/2026 through 2028/2029 DY

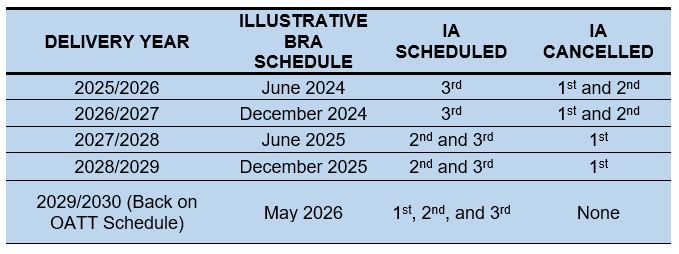

On April 11, 2023, PJM Interconnection (PJM) submitted proposed revisions of its Open Access Transmission Tariff (OATT) to the Federal Energy Regulatory Commission (FERC). In their proposal, PJM requested to delay their Base Residual Auction (BRA) and Incremental Auction (IA) schedules for the 2025/2026 through 2028/2029 delivery year (DY). In their filing, PJM indicated that it requested the delay so that the auctions could take place after FERC’s action on PJM’s anticipated upcoming capacity market enhancements are filed. PJM plans to file those market enhancements by October 1, 2023.

Accompanying its proposed revisions , PJM asserted that capacity sellers should know the outcome of potential capacity market rule enhancements before they make concrete auction preparations and that market enhancements were necessary to address issues related to the “energy transition” projected to continue in PJM as “lower-carbon intermittent resources are the predominant resource type entering the PJM market, while thermal generation resources are retiring due to a number of economic and policy-driven conditions.”

On June 9, 2023 FERC issued its order that accepted the proposed revisions to PJM’s OATT and approved the delays of the BRAs and IAs for the 2025/2026 through 2029/2029 DYs. While FERC has ordered that PJM submit a revised schedule for those auctions, a summary of PJM’s illustrative schedule for the BRAs and IAs that was included in its FERC filing is shown in the table below.

Table 1: Illustrative Schedule for BRAs and IAs for 2025/2026 Through 2029/2030 DY

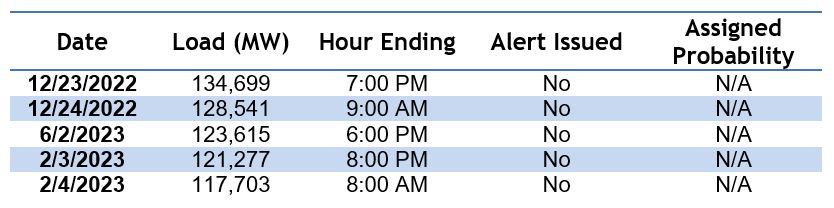

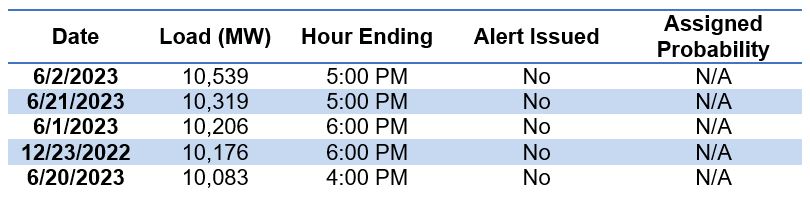

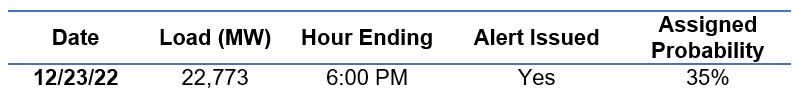

Peak Loads for Summer 2023

Brakey Energy provides email and text alerts in advance of potential Capacity and Transmission Coincident Peaks (CPs) to those clients that elect to receive them. As of June 21, 2023, Brakey Energy has not issued any Capacity CP alerts, FirstEnergy-Ohio (FE) Transmission CP alerts, or AEP Ohio CP alerts for Summer 2023. Load and weather forecasts since June 1 have been well below peak load forecasts for PJM, FE’s transmission zone, and the AEP Zone.

Capacity CPs occur during the five one-hour intervals when demand on the PJM grid is at its highest. Transmission CPs for FE customers occur during the five one-hour intervals when demand on FE’s zonal grid is at its highest. The Transmission CP for AEP customers occurs during the one-hour interval when demand on AEP’s zonal grid is at its highest.

The tables below list PJM’s and FE’s five highest loads and AEP’s single highest load this year, as well as the day and time of each occurrence. This is based on preliminary data.

Table 2: Five Highest Loads for PJM through June 22, 2023

Table 3: Five Highest Loads for FE through June 22, 2023

Table 4: Single Highest Load for AEP through June 22, 2023

In our 2023 Coincident Peak Forecasting Report, we forecasted that the 1CP and 5CP for PJM will be 147,433 MW and 142,541 MW, respectively, and that the 1CP and 5CP for FE would register at 12,656 MW and 12,149 MW, respectively. PJM and FE’s top five peak loads to date have fallen notably below this range. With all of July, August, and September yet to come, we expect that all of the loads shown in Tables 2 and 3 will be displaced.

In our 2023 Coincident Peak Forecasting Report, we discussed the strong likelihood that the load during the HE 6:00 PM on December 23, 2022 may end up setting the 1CP for the AEP Zone between November 1, 2022 and October 31, 2023.

Brakey Energy will continue to monitor weather and load forecasts and will issue alerts to participating clients when warranted. If you are a Brakey Energy client that has not signed up for these alerts but would like to, please email Catherine Nickoson.

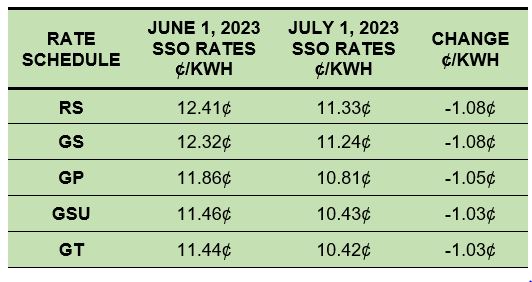

FE Announces Updates to SSO Rates

Electric costs will be decreasing on July 1 for FE customers that take electric generation service under Ohio Edison’s (OE), the Illuminating Company’s (CEI), and Toledo Edison’s (TE) Standard Service Offer (SSO). The SSO is the default rate charged by the utility for generation services to customers that do not contract with an alternative supplier. FE’s SSO generation rates are higher in the three summer months of June, July, and August than they are in the other nine months of the year.

The tables below compare the current and July 1 SSO rates per kWh for OE, CEI, and TE Residential (RS), Secondary (GS), Primary (GP), Subtransmission (GSU), and Transmission (GT) rate schedules. These rates will change again on September 1.

Table 5: OE SSO Rates

Table 6: CEI SSO Rates

Table 7: TE SSO Rates

Despite the decrease, SSO rates remain so significantly above market that virtually all customers should be competitively sourcing power. If you would like more information about how FE’s recent SSO rate updates will impact your monthly electric costs, please contact Katie Emling.

Residential Corner

Now that SSO rates have skyrocketed, it is urgent that residential customers competitively source power and not default to their electric distribution utility. The last two residential offers we have highlighted have since been pulled. AEP Energy is now offering 6.00¢ per kWh for a 12-month agreement. We believe this to be the most compelling offer currently on the market.

Regarding natural gas, to the extent you entered into a fixed-price residential natural gas contract that does not include an early termination fee, including the residential offers Brakey Energy highlighted prior to this past winter, you should seek to exit and either enter into a new agreement or default to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market – especially through the fall. To employ this strategy, you simply need to provide termination notice to your existing supplier and you will automatically be defaulted to the SCO.

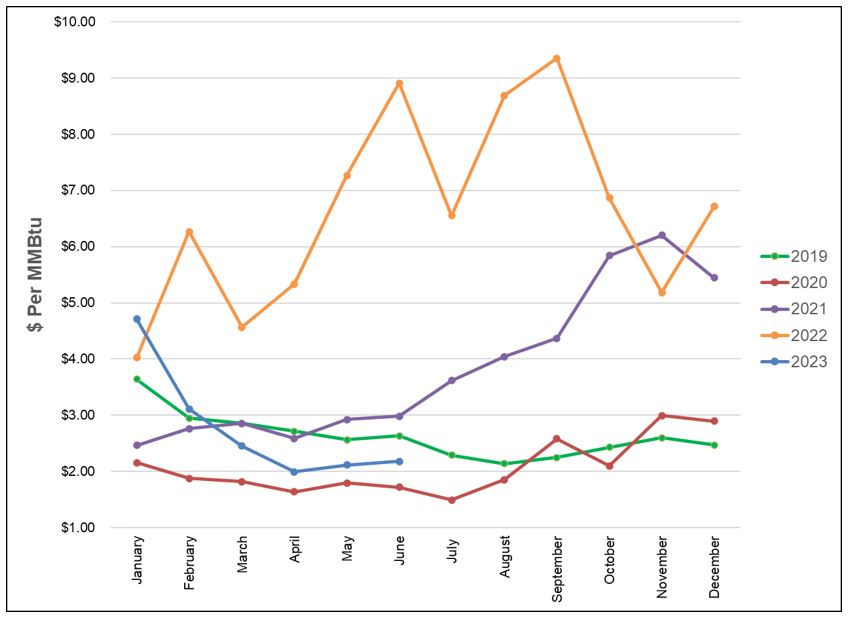

Natural Gas Market Update

The NYMEX price for June settled at $2.181 per Million British Thermal Units (MMBtu) on May 26, 2023. This price is up 3.0% from May’s price of $2.117 per MMBtu. This settlement price is used to calculate June gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2019, 2020, 2021, 2022, and 2023 to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

Figure 2 below shows the historical June 23, 2021 through June 23, 2023 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2023 (labeled “Custom Strip” in the graph below) and calendar years 2024, 2025, 2026, 2027, and 2028. Natural gas prices for the balance of 2023 and calendar year 2024 continue to trade at lower levels compared to outlier years, reflecting a state of contango in the market after a long period of backwardation.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Electricity Market Update

Figure 3 below shows the historical June 23, 2021 through June 23, 2023 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2023 (labeled “Custom Strip” in the graph below) and calendar years 2024, 2025, 2026, 2027, and 2028 for the AD Hub. Like gas, the power market finds itself in a state of contango.

Figure 3: ATC Calendar Year Power Prices for the AD Hub