Ohio Energy Report: May 2025

Governor DeWine Signs House Bill 15 Into Law

On May 15, 2025, Ohio Governor Mike DeWine signed Substitute House Bill 15 (HB 15) into law, enacting sweeping reforms to the state’s energy policy that will affect consumers, utilities, and the broader energy market. Introduced in the Senate just four months earlier, HB 15 represents a comprehensive overhaul focused on consumer protection, market competitiveness, and the advancement of renewable energy.

When the law takes effect on August 14, 2025, Ohio residents and businesses can expect more transparent utility practices, potential reductions in electricity costs, and expanded opportunities for local energy generation. Key provisions of HB 15 include:

- Immediate repeal of the “legacy generation rider” established by House Bill 6 (HB 6), eliminating subsidies for Ohio Valley Electric Corporation coal plants,

- Elimination of the Solar Generation Fund created by HB 6,

- Mandates requiring utilities to refund customers for charges deemed unlawful by the Ohio Supreme Court, retroactive to the date of the ruling,

- Requirements for utilities to publish heat and capacity maps of their distribution systems to promote transparency and aid infrastructure planning,

- Elimination of Electric Security Plans (ESPs) upon the conclusion of each utility’s current auction schedule,

- A mandate for electric distribution utilities to file base rate cases every three years,

- Stricter deadlines for the Public Utilities Commission of Ohio and the Ohio Power Siting Board to expedite reviews of rate cases and siting applications,

- A ban on utility ownership or operation of electric generating facilities, supporting a competitive generation market,

- Expanded rights for customer-owned behind-the-meter generation, encouraging energy independence and potential cost savings, and

- Incentives for renewable energy development on brownfields and former industrial sites, including tax benefits and streamlined permitting.

If you have any questions about HB 15 or how you or your business may be impacted, please reach out to Katie Emling.

Take Steps This Summer to Mitigate Your 2026/2027 Capacity Costs

The start of this summer’s capacity cost management period is just two weeks away. For customers on generation contracts that pass through capacity charges, these charges are based on the customer’s metered demand during the five one-hour intervals when demand on PJM’s electric grid is at its highest. These intervals—known as Coincident Peaks (CPs)—typically occur during June, July, August, or September. A customer’s average demand during these CPs determines its capacity charges for the next delivery year, which runs from June 1 through May 31.

PJM’s capacity rate will increase ninefold on June 1, 2025, and we expect prices to remain elevated in future delivery years. Although capacity auctions for the 2026/2027 and 2027/2028 delivery years have not yet occurred, the Federal Energy Regulatory Commission recently approved a price floor and ceiling for the next two auctions: capacity prices will range between $175/MW-day and $325/MW-day.

To help manage capacity charges for the 2026/2027 delivery year, customers can take steps to reduce demand during this summer’s CPs. Brakey Energy supports these efforts through our CP alert notification system, which allows participating customers to reduce electric usage during forecasted peak periods.

We’ve issued a report to clients enrolled to receive CP alerts this summer. The report outlines historic CP trends and provides our summer peak load forecasts. If you did not receive the report, you are not currently enrolled to receive summer CP alerts.

If you are not enrolled to receive these alerts and would like to participate, please email Catherine Nickoson. Please also contact Catherine to change your registration preferences, including adding or deleting which employees receive the alerts. This is a service available only to Brakey Energy clients.

Take Steps This Summer to Mitigate Your 2026 Transmission Costs

While managing capacity costs is important, many customers can achieve comparable savings through transmission cost management. Eligible FirstEnergy (FE) customers may opt out of the utility’s transmission-related riders and instead pay for transmission and related services through their certified retail electric service (CRES) suppliers, based on their Network Service Peak Load (NSPL). Participation in FE’s transmission pilot program is currently limited to customers identified in the ESP IV case or those who gained access during the brief expansion of the program under ESP V.

American Electric Power (AEP) offers a similar transmission pilot program under its modified ESP III. However, unlike FE, AEP bills customers directly rather than through their CRES providers. Participation is currently limited to customers grandfathered into the program in July 2024 or those who enrolled during the December 2024 expansion under AEP’s ESP V. Customers interested in joining the program in April 2026 will have the opportunity to enroll through a first-come, first-served queue that reopens on December 1, 2025.

For FE and AEP customers currently enrolled in a transmission pilot program—or those planning to join AEP’s program in April 2026—transmission charges for next year will be based on each customer’s demand during the 2025 Transmission Coincident Peaks (CPs).

For AES Ohio non-residential customers served at primary voltage and above, as well as secondary-voltage non-residential customers who opt in, 2026 transmission charges will be based on demand during AES Ohio’s single CP set this summer.

To help reduce transmission charges, eligible FE and AEP pilot program customers—as well as applicable AES Ohio customers—can take steps to lower demand during Transmission CPs. Brakey Energy supports these efforts through our CP alert notification system. Participating clients receive alerts in advance of anticipated CPs and can reduce electric usage during those periods. This service is available exclusively to Brakey Energy clients.

If you are a participating client that would like to change your registration preferences, including adding or deleting which employees receive the alerts, please email Catherine Nickoson.

PUCO Approves Duke’s ESP V

On May 14, 2025, the Public Utilities Commission of Ohio (PUCO) issued its Opinion and Order approving Duke Energy Ohio’s Fifth Electric Security Plan (ESP V), covering the period from June 1, 2025, through May 31, 2028. The PUCO adopted a comprehensive settlement (“Stipulation”) reached among Duke, Commission Staff, and numerous stakeholders, including consumer advocates and trade associations. Following the signing of House Bill 15 (HB 15) by Governor Mike DeWine on May 15, ESP V is expected to be Duke’s final electric security plan.

The PUCO found that the Stipulation met its three-prong test: it resulted from serious bargaining among capable parties, benefited the public interest, and complied with regulatory principles.

Under ESP V, Duke will continue to use competitive auctions to procure Standard Service Offer (SSO) generation, with modifications designed to reduce price volatility and supplier risk, such as eliminating three-year bids. Other key provisions of ESP V include:

- New revenue caps on key riders, including the Distribution Capital Investment Rider and the Electric Service Reliability Rider,

- Withdrawal of several proposed riders, including the Infrastructure Modernization Rider and most of Duke’s proposed energy efficiency and demand-side management programs, except for a low-income energy efficiency (EE) program,

- Implementation of a $7.2 million EE program for eligible low-income customers, along with a $575,000 shareholder contribution for payment assistance and customer education, and

- A commitment by Duke to file a base distribution rate case by June 30, 2027.

If you are an Ohio customer served by Duke and have questions about how you may be impacted by ESP V, please contact Katie Emling.

Residential Corner

The sky-high Base Residual Auction (BRA) clearing price has resulted in all offers being materially higher than what customers are accustomed to. Users looking to hide on a low short-term rate can contract with American Power & Gas for three months at an artificially low 5.59¢ per kWh. Just know that this is a teaser rate and be sure to enter into a new contract before expiration to avoid a sky-high holdover provision!

The best longer term option is a 8.09¢ six-month offer from Energy Harbor. These types of high prices are going to be a shock to residential customers, but there is no getting around this surge in capacity prices.

Regarding natural gas, Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide a termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

The NYMEX price for May settled at $3.170 per Million British Thermal Units (MMBtu) on April 28, 2025. This price is down 19.7% from the April 2025 price of $3.950 per MMBtu. This settlement price is used to calculate May gas supply costs for customers that contract for a NYMEX-based index gas product.

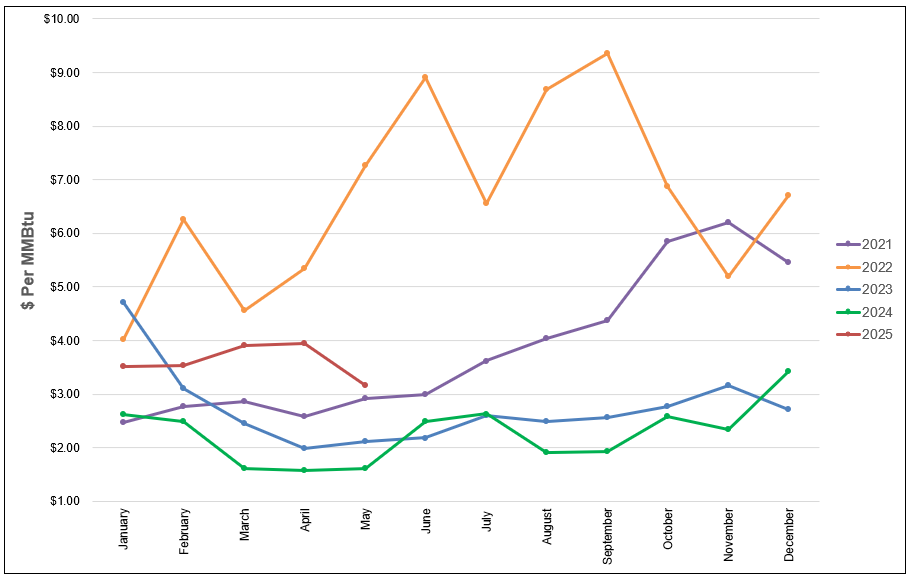

The graph below shows the year-over-year monthly NYMEX settlement prices for 2021, 2022, 2023, 2024, and 2025 year-to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

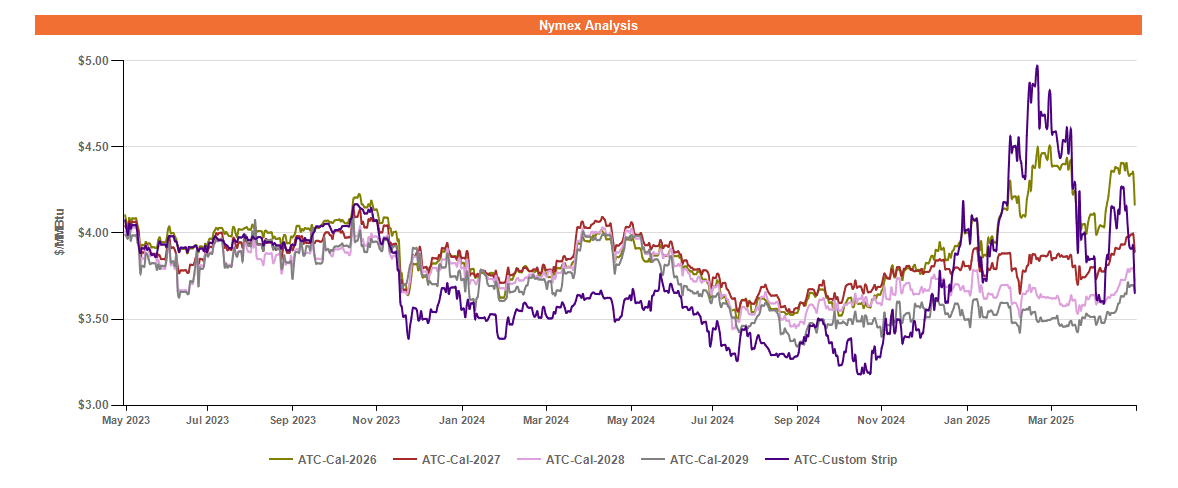

Figure 2 below shows the historical May 21, 2023 through May 21, 2025 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2025 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, and 2029.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Electricity Market Update

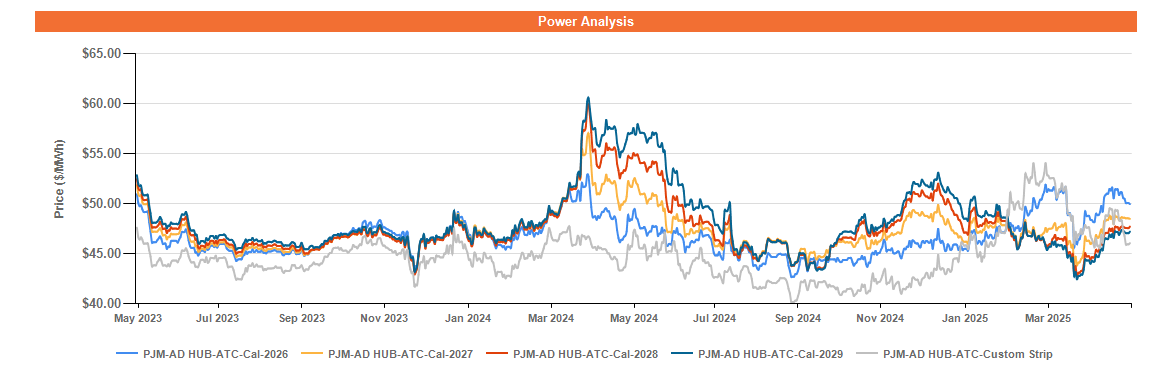

Figure 3 below shows the historical May 21, 2023 through May 21, 2025 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2025 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, and 2029 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

* Pricing courtesy of Direct Energy Business.