Ohio Energy Report: November 2025

Take Steps This Winter to Mitigate Your Transmission Costs

Eligible electric customers in the service territories of American Electric Power (AEP) Ohio, FirstEnergy (FE), and AES Ohio can reduce their transmission costs by lowering demand on specific days when load peaks across a transmission zone. These peak hours are known as Transmission Coincident Peaks (Transmission CPs). Under transmission pilot programs, customers are charged for transmission based on their demand during these hourly Transmission CPs, rather than the default method, which uses monthly billed demand.

For the 2027 calendar year, transmission charges for transmission pilot program customers will be based on their demand during the Transmission CPs that occur in the 12 months ending October 31, 2026. Historically, Transmission CPs in the FE and AES Ohio service territories have occurred exclusively during the summer. In contrast, the single-hour CP (1 CP) in the AEP Zone has also occurred during winter months.

Over the past ten years, half of the AEP Zone’s 1 CP events have taken place in the winter. In four of those five years, the 1 CP occurred during the hour ending (HE) 8:00 AM or 9:00 AM Eastern Standard Time (EST).

We recommend that AEP customers currently enrolled in AEP’s transmission pilot program take steps this winter to curtail load in response to potential Transmission CPs, especially during HE 8:00 AM and HE 9:00 AM EST on potential 1 CP days.

To support customers in reducing demand during Transmission CPs, Brakey Energy has developed an alert notification system. This service is available only to Brakey Energy clients. Participating clients can modify their registration preferences by emailing Catherine Nickoson.

AES Ohio Files New Distribution Rates and First Three-Year Forecasted Rate Case Application

Following the Public Utilities Commission of Ohio’s (PUCO) November 5, 2025 Opinion and Order approving the settlement stipulation in AES Ohio’s 2024 Base Distribution Rate Case, new base distribution rates took effect on November 6.

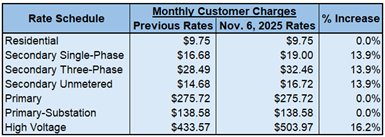

As shown in Table 1, monthly customer charges will remain unchanged for Residential, Primary, and Primary-Substation rate classes. Secondary customers now face a 13.9% increase, while High Voltage customers see a 16.2% increase to their sole base distribution charge.

Table 1. AES Ohio’s Previous and Current Monthly Customer Charges

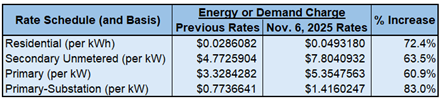

Table 2 summarizes changes to the energy- or demand-based components of base distribution charges. Residential customers experienced a 72.4% increase to the energy charge, while nonresidential demand charges rose between 60.9% and 83.0%, depending on the rate class.

Table 2. AES Ohio’s Previous and Current Base Distribution Energy or Demand Charges

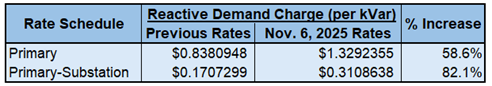

Base distribution costs for Primary and Primary-Substation customers also include reactive demand charges. Increases to these charges that became effective November 6 are shown in Table 3.

Table 3. AES Ohio’s Previous and Current Reactive Demand Charges

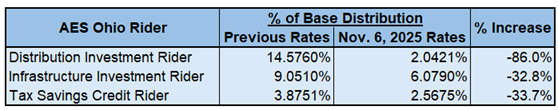

Additionally, some distribution riders decreased as a result of certain cost-recovery mechanisms being rolled into base distribution rates. Table 4 presents the previous and new rates for AES Ohio’s Distribution Investment Rider, Infrastructure Investment Rider, and Tax Savings Credit Rider, which are billed as a percentage of base distribution charges.

Table 4. Summary of Changes to AES Ohio’s Base Distribution Riders

Separately, AES Ohio became the first electric distribution utility (EDU) in Ohio to file a three-year forecasted rate plan, as required under Ohio House Bill 15 enacted earlier this year. This new filing proposes base distribution rates for 2027, 2028, and 2029.

If you have questions about how these updated rates may affect you or your business, or if you would like additional information regarding the three-year rate plan filed November 10, please contact Katie Emling.

New Enbridge Gas Ohio Rates Went Into Effect November 1

On November 1, 2025, new base distribution rates took effect for Enbridge Gas Ohio, operating as The East Ohio Gas Company (EOG). These rates are the outcome of a nearly two-year regulatory process before the Public Utilities Commission of Ohio (PUCO), which began with EOG’s initial application filed on October 31, 2023.

Throughout the case, Matt Brakey, President of Brakey Energy, served as an expert witness on three occasions, providing analysis of bill impacts on commercial and industrial customers and advocating on behalf of Brakey Energy clients and Ohio Energy Leadership Council members.

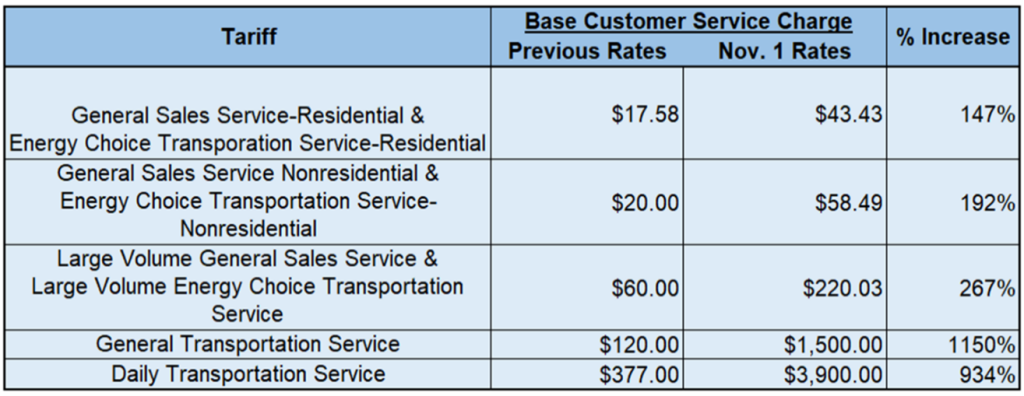

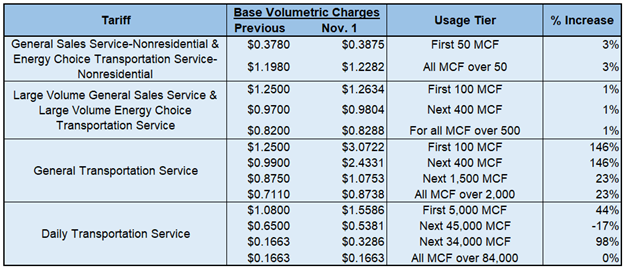

Tables 5 and 6 below summarize the changes to monthly customer charges and volumetric delivery charges by tariff class, comparing prior rates to those effective November 1.

Table 5. Summary of Changes to EOG’s Monthly Customer Service Charges

Table 6. Summary of Changes to EOG’s Volumetric Delivery Charges

In addition to the base distribution updates described above, the November 1 rate implementation also impacted several riders, including:

- AMR Cost Recovery Charge

- Capital Expenditure Program Rider

- Gross Receipts Tax

- Pipeline Infrastructure Replacement Cost Recovery Charge

- Tax Savings Credit Rider

- Transportation Surcredit Rider

The Transportation Migration Rider – Part A was also eliminated, and Part B was revised and renamed the Operational Balancing Rider.

If you have any questions about the results of the EOG base rate case, or how you or your business may be impacted by the new rates, please contact Katie Emling.

Residential Corner

Sky-high Base Residual Auction (BRA) clearing prices have resulted in elevated generation offers now for months. Winter power prices recently running up has only made this problem worse.

We recommend customers with an approaching contract expiration migrate to a short-term six-month offer with Direct Energy for 8.59¢/kWh.

Regarding natural gas, Brakey Energy has long and often found defaulting to distribution utilities’ Standard Choice Offer a prudent strategy for natural gas supply. However, Columbia Gas of Ohio (“Columbia”) rates have recently jumped. For Columbia customers, and for any customer wanting price certainty this winter, Energy Harbor is currently offering a six-month deal for $0.5690/ccf. This price will vary depending on distribution utility.

Natural Gas Market Update

The NYMEX price for November settled at $3.376 per Million British Thermal Units (MMBtu) on September 26, 2025. This price is up 19.1% from the October 2025 price of $2.835 per MMBtu. This settlement price is used to calculate November gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2021, 2022, 2023, 2024, and 2025 year-to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

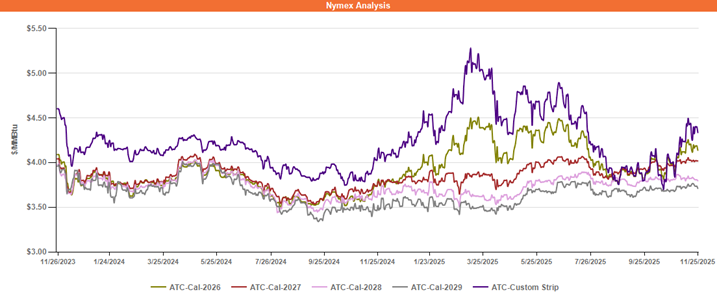

Figure 2 below shows the historical November 25, 2023 through November 25, 2025 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for December 2025 – March 2026 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, and 2029.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

The focus in the forward gas market remains in the near term through Q2 2026 as winter approaches and weather forecasts are closely watched. Meteorologists are calling for the presence of a weak-moderate La Nina through at least January, which is similar to last winter, and brings the possibility of cold snaps hitting the Midwest United States at times. However, strong production and high gas storage levels near 3,900 BCF have helped keep a lid on near-term gas forward prices.

Beyond Q2 2026, gas continues to trade mostly flat, as has been the case for most of this year. The entire forward gas market remains in a state of backwardation due to the anticipation of a global LNG export supply glut in 2027 and beyond, which would keep more gas available domestically and depress prices.

Electricity Market Update

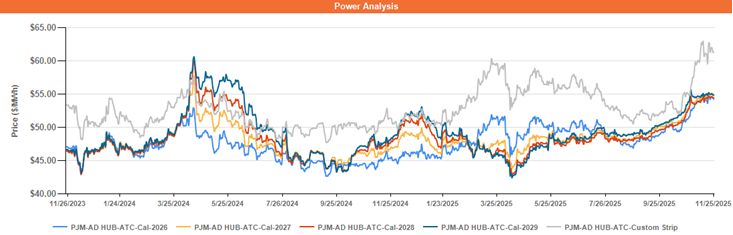

Figure 3 below shows the historical November 25, 2023 through November 25, 2025 ATC forward power prices in dollars per Megawatt hour (MWh) for December 2025 – March 2026 (labeled as “Custom Strip”) and calendar years 2026, 2027, 2028, and 2029 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

* Pricing courtesy of Direct Energy Business.

The forward power market has become somewhat disconnected from the forward gas market in recent weeks – forward power prices have run up significantly without a commensurate simultaneous rise in forward gas prices, particularly in outlier years. Additionally, the forward power market has entered a state of contango, the opposite of the gas market’s backwardation.

Market participants have grown increasingly nervous over the forecasted power demands from data centers and the currently forecasted shortfall in generation capacity to meet these demands. These fears have led to the formation of a significant risk premium in forward power prices, regardless of trends in the gas market, and has pushed forward power prices towards their highest levels in the last five years.