Ohio Energy Report: October 2023

Matt Brakey Files Testimony in FirstEnergy ESP V Case on Behalf of OELC

On October 23, 2023, Regulatory Counsel for the Ohio Energy Leadership Council (OELC) submitted the direct testimony of Matt Brakey in FirstEnergy’s (FE) Fifth Electric Security Plan (ESP V) case before the Public Utilities Commission of Ohio (PUCO). In his testimony, Matt voices support for (1) FE’s Non-Market-Based Services Rider (“Rider NMB”) Pilot Program, and (2) FE’s interruptible program, known as the Economic Load Response Program Rider (Rider ELR).

In addition to discussing the benefits of FE’s Rider NMB Pilot Program, which allows customers to be billed for transmission charges based on their Network Service Peak Load (NSPL), Matt points out several flaws with FE’s proposal to switch all non-residential customers that have advanced or interval meters to NSPL-based billing for transmission. Instead of utilizing an arbitrary criteria of meter type to switch more than 73,000 non-residential customers to NSPL based billing for transmission, he proposes a gradual transition of FE’s Rider NMB Pilot Program through an expansion of the program. Matt further opposes the reduction of the Rider ELR credits proposed by FE and proposes that if FE desires to end its role as the curtailment service provider for Rider ELR customers, that should commence no earlier than the June 1, 2025 to May, 31, 2026 delivery year.

Initial settlement meetings between FE and intervening parties have not been successful and the Attorney Examiner in the case has established that the evidentiary hearing on FE’s ESP V will begin on November 7, 2023 at the offices of the PUCO. Brakey Energy will provide updates on the case in future newsletters.

Please contact Matt Brakey if you have any questions about his testimony or how you may be impacted by FE’s ESP V case.

PJM Files Capacity Market Reforms with FERC

On October 13, 2023, PJM Interconnection (PJM) filed proposed capacity market reforms (Dockets No. ER24-98-000 and ER24-99-000) with the Federal Energy Regulatory Commission (FERC). These companion filings came after more than one year of stakeholder meetings that began in October 2021 and an accelerated stakeholder process that began with a sense of urgency in February 2023 in the aftermath of Winter Storm Elliott.

The two filings propose how PJM plans to maintain resource adequacy at a reasonable cost during the energy transition detailed in its February 2023 report through, among other reforms, (1) enhanced generator reliability-related risk modeling, (2) an accreditation framework for resource capacity values, (3) reform of Capacity Performance program rules, (4) improved generator testing requirements, and (5) revisions to rules related to the Market Seller Offer Cap, the Minimum Offer Price Rule, and Fixed Resource Requirements. According to Adam Keech, PJM’s Vice President of Market Design and Economics, “The proposal, while enhancing reliability, would maintain fundamental principles of competition that control costs for consumers as well as incentivize investment in new resources.”

PJM has urged the FERC to jointly approve both proposals by December 12, 2023 in order to implement the reforms prior to the 2025/2026 Delivery Year’s Base Residual Auction that is scheduled for June 2024.

If you have any questions about PJM’s recent FERC filings and proposed capacity market reforms, please contact Katie Emling.

Carolyn Brakey’s Campaign Update

Carolyn and Matt Brakey made a recent visit to Great Lakes Cheese to tour one of Geauga County’s greatest economic success stories. Learn more about the visit, and be sure to sign up for future campaign updates, in Carolyn’s campaign newsletter.

Picture 1: Matt Brakey (far left), Carolyn Brakey (middle), and John Epprecht (right)

Carolyn will appear on the ballot in Geauga County for the March 2024 primary election. Thank you to all who have supported Carolyn thus far. Feel free to reach out to Carolyn to discuss the campaign!

Residential Corner

The best offer we are currently seeing is from AEP Energy for 12 months at a rate of 5.85¢/kWh. With a more expensive winter quickly approaching, the pricing we’re seeing on these residential offers has been creeping up.

Regarding natural gas, if you entered into a fixed-price residential natural gas contract that does not include an early termination fee, including the residential offers Brakey Energy highlighted prior to this past winter, you should seek to exit and either enter into a new agreement or default to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market – especially through the fall. To employ this strategy, you simply need to provide termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

The NYMEX price for October settled at $2.764 per Million British Thermal Units (MMBtu) on September 27, 2023. This price is up 8.1% from October’s price of $2.556 per MMBtu. This settlement price is used to calculate September gas supply costs for customers that contract for a NYMEX-based index gas product.

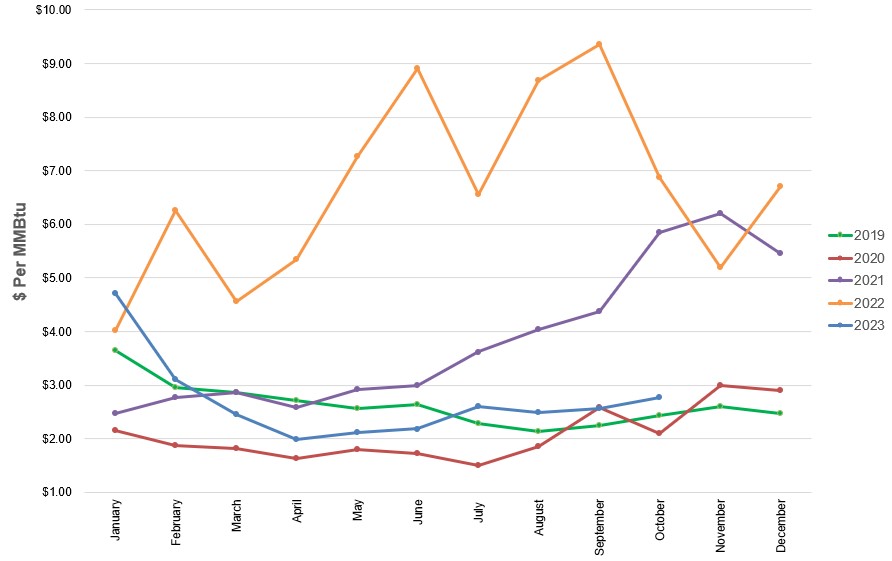

The graph below shows the year-over-year monthly NYMEX settlement prices for 2019, 2020, 2021, 2022, and 2023 to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

Figure 2 below shows the historical October 27, 2021 through October 27, 2023 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2023 through the First Quarter of 2024 (labeled as “Custom Strip” in the graph below) and calendar years 2024, 2025, 2026, 2027, and 2028. Following a brief and modest increase in short term natural gas prices early this month as shown by the Custom Strip and Calendar Year 2024 graphs, natural gas prices through 2024 are trading under $3.50 per MMBtu. Prices for outlier years are hovering just south of $4.00 per MMBtu with prices for the 2028 calendar year trading slightly lower than other outlier years.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Electricity Market Update

Figure 3 below shows the historical October 27, 2021 through October 27, 2023 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2023 through First Quarter 2024 (labeled “Custom Strip” in the graph below) and calendar years 2024, 2025, 2026, 2027, and 2028 for the AD Hub. Forward prices for calendar years 2025 through 2028 are hovering right around $47.00 per MWh and prices for calendar year 2024 that have been slowly increasing since July 2023 are trading just south of $45.00 per MWh.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

*Pricing courtesy of Direct Energy Business.