Ohio Energy Report: April 2024

PUCO Approves AEP ESP V Settlement

On April 3, 2024, the PUCO issued an Opinion and Order modifying and approving the Stipulation and Recommendation agreed upon by 17 signatory parties in AEP’s Fifth Electric Security Plan (ESP V) case. This Opinion and Order authorizes AEP to implement its ESP V for a four-year period beginning on June 1, 2024 and ending May 31, 2028. With the exception of one modification by the Public Utilities Commission of Ohio (PUCO) that will require AEP to fund a low-income assistance program instead of ratepayers, the PUCO approved the entirety of the settlement reached by intervening parties in the case.

The PUCO’s approval of AEP’s ESP V settlement will result in positive outcomes for commercial and industrial customers, particularly those that participate in AEP’s Basic Transmission Cost Recovery (BTCR) transmission pilot program or Interruptible Rate Programs (IRP). Customers that have participated in AEP’s BTCR transmission pilot program can elect to be grandfathered into the transmission pilot for the entire term of ESP V, with an option to exit after two years on May 31, 2026. ESP V also includes a provision to increase the enrollment in the BTCR transmission annually if the program’s capacity is not fully subscribed through load from existing participants. The program cap is currently 1,000 Megawatt (MW), but the program cap will be increasing 100 MW per year during the term of ESP V.

IRP-Legacy (IRP-L) and IRP-Legacy (IRP-L) customers will also have an opportunity to be grandfathered into those programs at the start of ESP V. Although IRP-L customers will see a reduction in their credits, the ESP V credits approved reflect a gradual phase down to reduce rate shock for participants. IRP-E customers will see a significant increase in interruptible credits on their utility bills beginning June 1, 2024 since IRP-Expanded credits will increase from 70% of the PJM Base Residual Auction market rate for the AEP Zone to 70% of the IRP-L credits. Similarly to the BTCR transmission pilot program, ESP V as approved contains a provision that will allow IRP-L customers to expand their participation load through a reasonable arrangement application with the PUCO.

If you have any questions about how AEP’s ESP V will impact your electric costs, please contact Katie Emling.

New Transmission Rates in Effect for AEP and FE Customers as of April 1, 2024

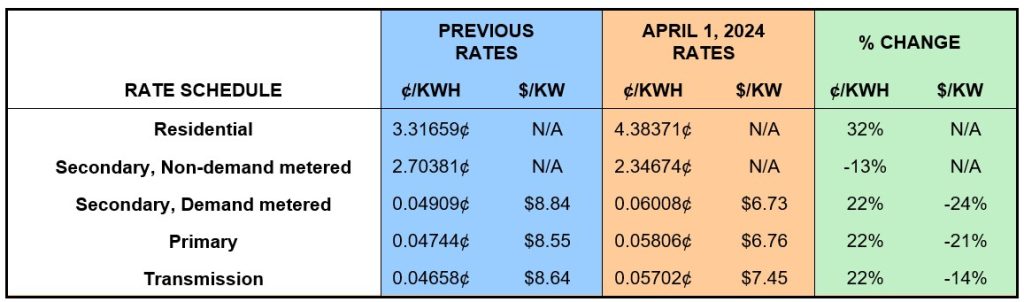

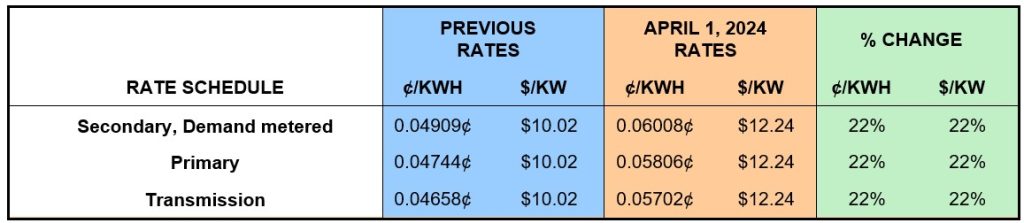

On March 22, 2024, AEP filed final updated rates to its BTCR rider that went into effect on April 1. The tables below show the previous and April 1, 2024 BTCR rates for non-transmission pilot program customers and transmission pilot program customers of AEP Ohio. The BTCR rider has both kilowatt-hour (kWh) consumption and kilowatt (kW) demand components.

Table 1: Previous and April 1, 2024 BTCR Rates for AEP Ohio Customers

Table 2: Previous and April 1, 2024 BTCR Rates for AEP Ohio Customers Participating in the Transmission Pilot Program

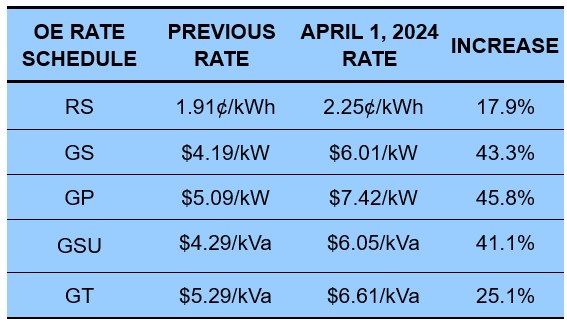

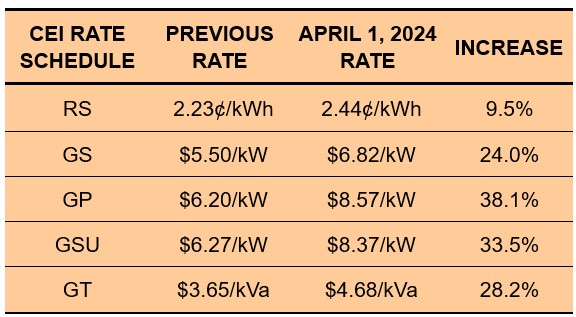

On March 21, 2024, FirstEnergy (FE) also filed final April 1 updated rates to its Non-Market-Based Services Rider (Rider NMB) for all three Ohio operating companies: Ohio Edison (OE), The Illuminating Company (CEI), and Toledo Edison (TE) based on the PUCO’s March 20 Finding and Order that limited the rate increase for some rate schedules. Since PUCO Staff’s recommended rate modifications will result in an under collection of charges, we expect FE to file updated rates for some rate schedules later this year.

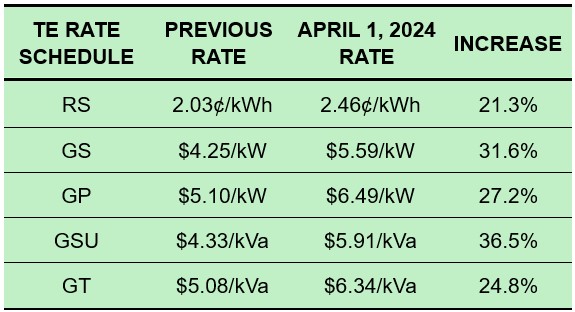

Previous and April 1, 2024 Rider NMB rates for OE, CEI, and TE Residential (RS), Secondary (GS), Primary (GP), Subtransmission (GSU), and Transmission (GT) rate schedules are shown in the tables below. Rates are per kWh for RS customers and per kW or kilovolt-ampere (kVa) for GS, GP, GSU, and GT customers. Customers that are participating in FE’s transmission pilot program are opted out of paying Rider NMB.

Table 3: OE Rider NMB Rates

Table 4: CEI Rider NMB Rates

Table 5: TE Rider NMB Rates

If you have any questions about how the new AEP BTCR and FE Rider NMB rates will impact your electric costs, please contact Katie Emling.

Generation Prices Expected to Decrease June 1, 2024 for Electric Customers Defaulting to Utilities’ SSO

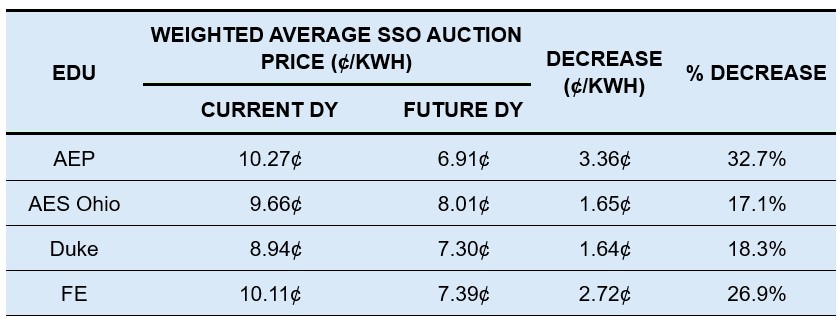

As of April 2, 2024, each of Ohio’s four electric distribution utilities (EDUs) have completed all of their SSO auctions for the June 1, 2024 to May 31, 2025 (2024/2025) DY. SSO auction prices will influence each EDU’s SSO rates, which are the default generation rates that residential and non-residential customers will pay if they are not shopping for generation or part of a government aggregation program.

As shown in the table below, the weighted average SSO auction prices for the upcoming DY are between 1.64¢ and 3.36¢ per kWh lower than the weighted average SSO auction prices for the current DY for AEP, AES Ohio, Duke, and FE. This will result in a decrease in SSO generation rates for the 2024/2025 DY.

Table 6: Weighted Average SSO Auction Price for Current and Future DY

In a recent interview with Cleveland.com, Matt Brakey indicated that despite falling SSO auction prices, SSO rates “will still likely be more expensive than what customers can find on the open market.” Customers who entered into long term contracts in 2023 may be able to shop for a lower generation rate for the balance of 2024 since short term electricity prices have fallen in recent months.

Duke Energy Ohio Files ESP V Application with the PUCO

On April 1, 2024, Duke Energy Ohio (“Duke”) filed its fifth Electric Security Plan (ESP V) application with the PUCO. This ESP would start on June 1, 2025 after Duke’s current ESP expires and would continue for a three-year period through May 31, 2028.

At the center of the ESP V application is Duke’s proposal to maintain its Competitive Bidding Process (CBP) to secure load for Standard Service Offer (SSO) customers. Also included in the ESP V application are plans to continue or modify all of its existing non-bypassable riders and introduce new riders, including the Infrastructure Modernization Rider, the Solar For All Rider, the Senior Energy Assistance Credit Rider, and the Energy Efficiency and Demand-Side Management Rider.

Finally, Duke has proposed a number of tariff amendments and rate design changes, particularly ones related to time-of-day pricing. One of these rate design changes that could present benefits to nonresidential customers is Duke’s proposed Base Transmission Rider Time-of-Use Transmission pilot to help large nonresidential customers manage their transmission costs.

If you have any questions about Duke’s ESP V as filed with the PUCO, please contact Katie Emling.

Residential Corner

As Matt Brakey highlighted in a recent Cleveland.com article, the best offer we are currently seeing is from Santana Energy Services for 12 months at a rate of 5.14¢/kWh. Although relatively inexpensive to other offers, Santana has a large $100 early termination fee tied to this offering. Do not enter into this agreement unless you are willing to stay under contract for the entire term. Also, be sure to set a calendar reminder to enter into a new agreement a year from your contract date so you don’t get caught in an expensive holdover provision.

Regarding natural gas, if you entered a fixed-price residential natural gas contract that does not include an early termination fee, including the residential offers Brakey Energy highlighted last year, you should seek to exit and either enter into a new agreement or default to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

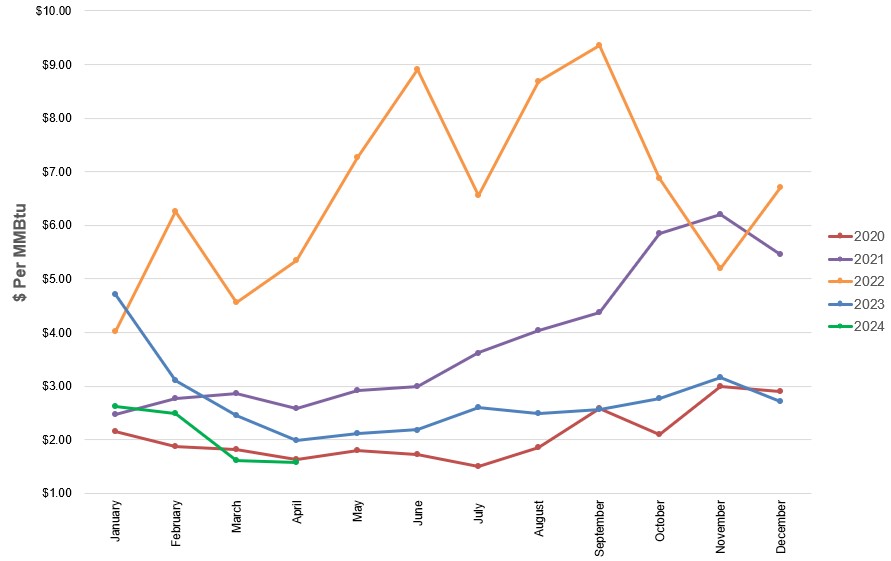

The NYMEX price for April settled at $1.575 per Million British Thermal Units (MMBtu) on March 27, 2024. This price is down 2.5% from the March 2024 price of $1.615 per MMBtu. This settlement price is used to calculate April gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2020, 2021, 2022, 2023, and 2024 year-to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

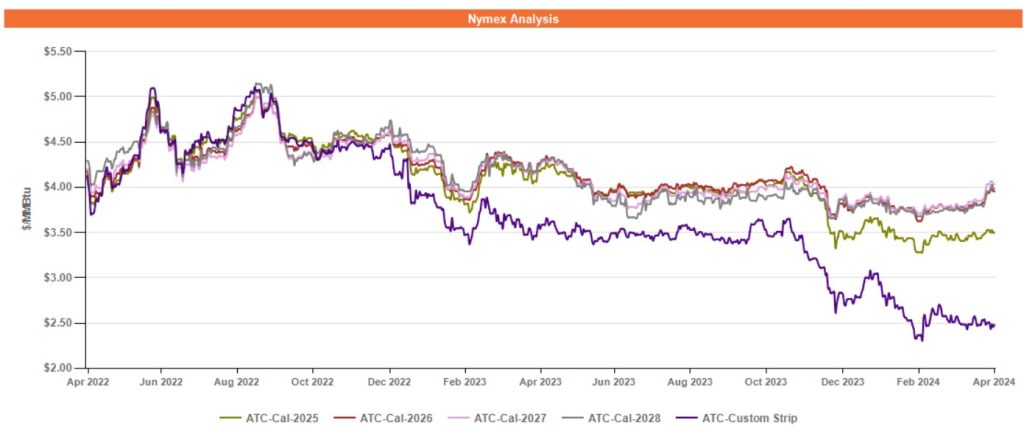

Figure 2 below shows the historical April 19, 2022 through April 19, 2024 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, and 2028.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Price action in the forward gas market has been muted. Although gas production has decreased from the all-time highs seen in the fourth quarter of last year, storage levels are approximately 23% higher than last year at this time and 39% higher than the 5-year average for this time of year. Market participants will be paying close attention to summer temperature forecasts and gas production figures as we move into late spring and early summer.

Electricity Market Update

Figure 3 below shows the historical April 19, 2022 through April 19, 2024 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, and 2028 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

* Pricing courtesy of Direct Energy Business.

Although forward power prices have increased across the board since the mid-February lows, forward power prices in outlying years beyond 2025 have seen exceptional volatility. Market participants are digesting multiple changes in power market fundamentals that are expected to take place over the remainder of the decade, namely: large increases in power demand from new data centers, the replacement of coal-fired generation with intermittent solar and wind generation, and potentially less available domestic supply of natural gas due to a near doubling of US export capacity of liquefied natural gas (LNG) by 2028.