Ohio Energy Report: May 2024

PUCO Approves FirstEnergy’s ESP V with Modifications

On May 15, 2024, the Public Utilities Commission of Ohio (PUCO) issued an Opinion and Order modifying and approving FirstEnergy’s (FE) Fifth Electric Security Plan (ESP V). This Opinion and Order authorizes FE to implement its ESP V for a five-year period beginning on June 1, 2024 and ending May 31, 2029.

The PUCO’s decision in FE’s ESP V case will result in positive outcomes for commercial and industrial customers, particularly those that participate in FE’s Non-Market-Based Services Rider (Rider NMB) Pilot Program.

Despite FE’s proposal to move all nonresidential customers with interval or advanced smart meters to transmission billing based on Network Service Peak Load (NSPL), the PUCO rejected FE’s proposal and ordered that the Rider NMB Pilot Program continue in its current form through ESP V. The PUCO also directed FE to expand the program for new customers with an aggregate load not to exceed 100 Megawatts (MW) on a first-come, first-served basis, beginning June 1, 2024. Each new participant will be capped at 20 MW.

In another positive outcome for commercial and industrial customers with interruptible loads, the PUCO ordered the continuation of FE’s Economic Load Response Program Rider (Rider ELR) for the ESP V term. However, ELR credits will begin a gradual decline on June 1, 2024 from the current credit rate of $10/kW-month of curtailable load.

The credits will be $8/kW-month on June 1, 2024 for the first year of ESP V, $7/kW-month from June 1, 2025 to May 31, 2027, and $6/kW-month from June 1, 2027 to May 31, 2029. In addition to modifying the ELR credits, the PUCO also ordered procedural changes to Rider ELR including allowing ELR customers to enroll in PJM demand response with a curtailment service provider, other than FE, and allowing participants to reset their firm service level annually, without changing their interruptible load subscription. Although the PUCO did not approve an expansion of the ELR program, FE customers may apply for enrollment in the program through a reasonable arrangement application with the PUCO.

Under Ohio law, FE has the option to withdraw its ESP application. If FE does so, then it would continue to operate under the terms of ESP IV. If FE chooses not to withdraw, then its ESP V plan will go into effect on June 1, 2024.

If you have any questions about how FE’s ESP V will impact your electric costs, please contact Katie Emling.

Take Steps This Summer to Mitigate Your 2025/2026 Capacity Costs

The start of this summer’s capacity cost management period is only two weeks away. For customers currently on a generation contract in which capacity charges are passed through, capacity charges are based on the customer’s metered demand during the five one-hour intervals of the year when demand on PJM’s electric grid is at its highest. These peak intervals, or Coincident Peaks (CPs), can occur during the months of June, July, August, and September. The customer’s average demand during Capacity CPs is used to determine its capacity charges for the next delivery year, which runs from June 1 through May 31.

In order to reduce the impact of capacity charges for the 2025/2026 delivery year, customers can implement measures to reduce demand during CPs that will be set this summer. To assist customers in their efforts to reduce demand during CPs, Brakey Energy provides an alert notification system. Customers that participate in the system can opt to reduce electric usage during alerted times.

Brakey Energy has issued a report to our clients that are enrolled to receive Capacity CP alerts this summer. The report discusses historic CP trends and provides our summer peak load forecasts. If you have not received this report, then we do not have you on our current enrollment list to receive summer CP alerts.

If you are not enrolled to receive these alerts and would like to participate, please email Catherine Nickoson. Please also contact Catherine to change your registration preferences, including adding or deleting which employees receive the alerts. This is a service available only to Brakey Energy clients.

Take Steps This Summer to Mitigate Your 2025 Transmission Costs

While capacity cost management is important, many customers can see the most pronounced savings through transmission cost management. Eligible FE customers can opt out of paying the utilities’ transmission-related riders and instead pay for transmission and other related services to their certified retail electric service suppliers based on their Network Service Peak Load (NSPL). Participation in FE’s transmission pilot program is currently limited to the customers identified in FE’s ESP IV case. However, the PUCO has ordered a limited expansion of the program for new customers beginning June 1, 2024

American Electric Power (AEP) implemented a similar transmission pilot program as part of its modified ESP III. However, unlike in FE territory, the billing is not through a customer’s retail supplier and instead is handled directly by AEP. Participation in AEP’s pilot program is currently limited to a select group of customers. However, AEP’s ESP V Settlement that was modified and approved by the PUCO stipulated a 100 MW annual expansion of the pilot program beginning April 1, 2025.

For FE and AEP customers that enrolled their accounts in one of the transmission pilot programs, or those that intend to enroll in 2025, each customer’s transmission charges for the 2025 calendar year will be based on the customer’s demand during Transmission CPs set in 2024.

Additionally, beginning June 1, 2025, all AES Ohio non-residential customers served at primary voltage and above, as well as any non-residential customers taking service at secondary voltage that opt-in, will be billed for transmission based on their NSPL value based on Transmission CPs set this summer.

In order to reduce the impact of transmission charges, FE and AEP pilot program eligible customers and applicable nonresidential AES Ohio customers can implement measures to reduce demand during Transmission CPs. To assist customers in their efforts to reduce demand during CPs, Brakey Energy has devised an alert notification system. Customers that participate in the system can opt to reduce electric usage during alerted times. This is a service available only to Brakey Energy clients.

If you are a participating client that would like to change your registration preferences, including adding or deleting which employees receive the alerts, please email Catherine Nickoson.

Residential Corner

As Matt Brakey highlighted in a recent Cleveland.com article, the best offer we are currently seeing is from Santana Energy Services for 12 months at a rate of 5.09¢/kWh. Although relatively inexpensive to other offers, Santana has a large $100 early termination fee tied to this offering. Do not enter into this agreement unless you are willing to stay under contract for the entire term. Also, be sure to set a calendar reminder to enter into a new agreement a year from your contract date so you don’t get caught in an expensive holdover provision.

Regarding natural gas, if you entered a fixed-price residential natural gas contract that does not include an early termination fee, including the residential offers Brakey Energy highlighted last year, you should seek to exit and either enter into a new agreement or default to the Standard Choice Offer (SCO).

Brakey Energy has long and often found defaulting to distribution utilities’ SCO a prudent strategy for natural gas supply. We encourage our readers to utilize this strategy if they are comfortable riding the highly volatile natural gas market. To employ this strategy, you simply need to provide termination notice to your existing supplier and you will automatically be defaulted to the SCO.

Natural Gas Market Update

The NYMEX price for May settled at $1.614 per Million British Thermal Units (MMBtu) on April 26, 2024. This price is up 2.5% from the April 2024 price of $1.575 per MMBtu. This settlement price is used to calculate May gas supply costs for customers that contract for a NYMEX-based index gas product.

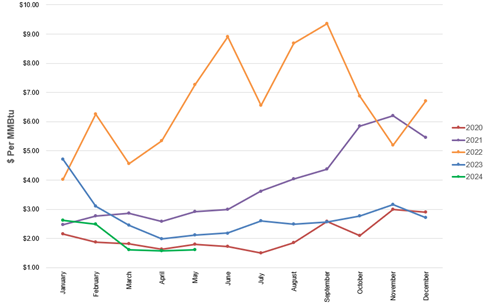

The graph below shows the year-over-year monthly NYMEX settlement prices for 2020, 2021, 2022, 2023, and 2024 year-to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

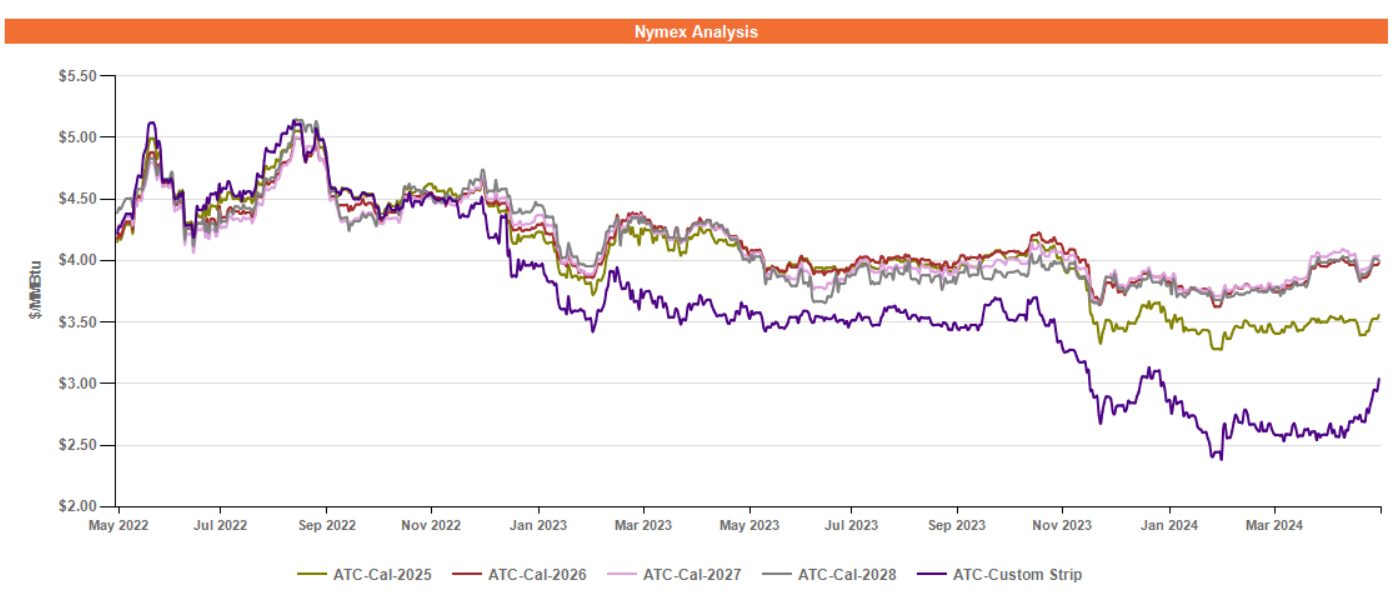

Figure 2 below shows the historical May 22, 2022 through May 22, 2024 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, and 2028.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Due to the gas supply glut that has developed due to record-high production in 2023 and a lack of winter demand, gas producers have cut production and are continuing to cut production. As we approach the summer, meteorologists’ temperature outlooks are largely leaning towards a warm summer. These forecasts, combined with gas production slowing and LNG exports returning to full capacity with the conclusion of maintenance at Freeport, have caused 2024 forward gas prices to rally. Prices in 2025 and beyond have remained more stable.

Electricity Market Update

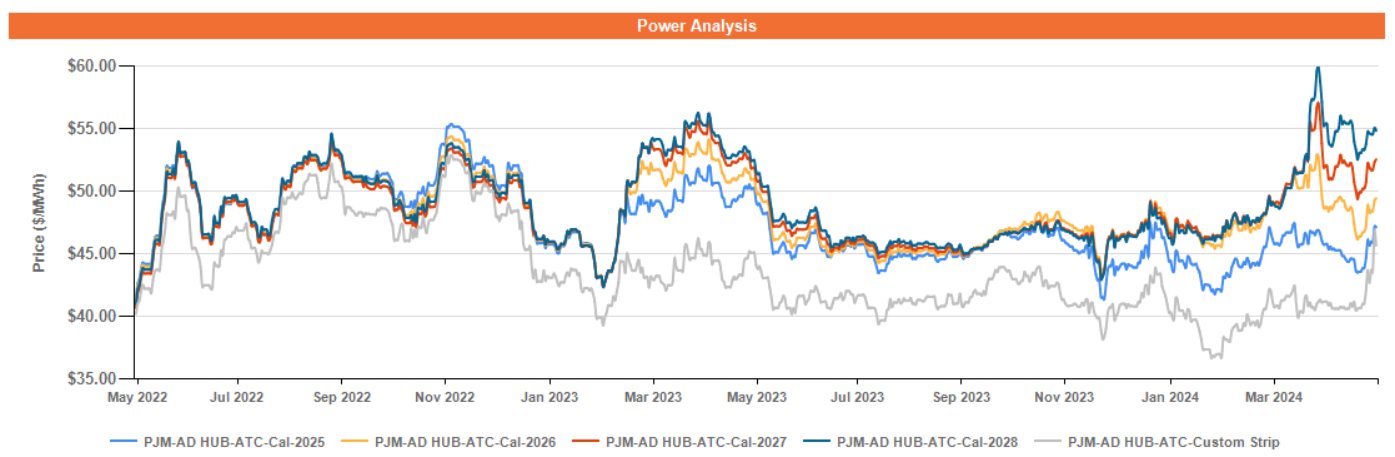

Figure 3 below shows the historical May 22, 2022 through May 22, 2024 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2024 (labeled as “Custom Strip”) and calendar years 2025, 2026, 2027, and 2028 for the AD Hub.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

*Pricing courtesy of Direct Energy Business.

The forward power market has experienced exceptional volatility in recent weeks. Forward power prices in the short term through 2024 are sensitive to summer temperature forecasts, and market participants have quickly reacted to these forecasts as well as the unseasonably warm temperatures that much of the country has experienced over the past week. Outlier years have also seen significant volatility, as market participants weigh the impact of developing crucial supply and demand factors, primarily, increasing load growth forecasts, increasing LNG exports, PJM’s capacity auction results, and the recently passed EPA regulations that will affect gas and coal-fired power plants.