Ohio Energy Report: March 2023

Industrial Energy Users-Ohio is now the Ohio Energy Leadership Council

After 30 years of utilizing their energy expertise to advocate for energy intensive manufacturing and industrial customers, the Industrial Energy Users-Ohio has changed its name to Ohio Energy Leadership Council (OELC). Members sought to start their next chapter as an organization as OELC to better align with the evolution of its currently diverse membership and refined mission: to serve as the premier advocate and resource for Ohio’s largest energy users. Renee Rambo, chair of OELC, unveiled the new name and logo at the 27th Annual Ohio Energy Savings & Management Conference held on February 28 and March 1, 2023 in Columbus, Ohio.

In a press release following the conference, David F. Proaño, Partner at the BakerHostetler law firm and OELC’s new regulatory counsel, noted that while industrial energy users remain founding members, “the organization and its mission has moved beyond the industrial sector and now includes energy leaders in manufacturing, education, information technology, and the retail industry representing a diverse cross section of energy interests in Ohio and around the nation.”

OELC is a group of energy-intensive manufacturing, industrial, institutional, information technology and business customers that are proven leaders in energy markets in Ohio and across the country. As major contributors to Ohio’s economy, OELC’s members have utilized their energy expertise to advocate for fair and transparent energy rates, promote reliable and reasonable utility service, and help other businesses benefit from opportunities in the energy markets.

Brakey Energy represents many of its clients’ interests in OELC through the Brakey Energy Client Group.

Duke and AEP Complete SSO Auctions for 2023/2024 Delivery Year

On January 10, 2023, Duke held its final Standard Service Offer (SSO) auction for the 2023-2024 Delivery Year (DY). The auction secured 80% of Duke’s SSO load for the DY and cleared at a price of 8.28¢ per kilowatt-hour (kWh). This is approximately 28% lower than the average clearing price from Duke’s first SSO auction held in September 2022 that secured 20% of their load for the 2023-2024 DY. Duke’s average weighted SSO auction price for the 2023/2024 DY is 8.94¢ kWh, which is approximately 59% higher than Duke’s average weighted SSO auction price for the current 2022/2023 DY.

American Electric Power (AEP) also held its final auction SSO auction for the 2023/2024 DY. The auction took place on March 7, 2023 and secured 55% of AEP’s expected load for their Ohio service territory. The auction cleared at a price of 8.85¢ per kWh, which was approximately 26% lower than the average clearing price from AEP’s first auction held in November 2022. AEP’s average weighted price for 2023/2024 DY is 10.27¢ per kWh, which is approximately 65% higher than AEP’s average weighted SSO auction price for the current 2022/2023 DY.

FirstEnergy (FE) and AES Ohio each have one Competitive Bidding Process auction date remaining to cover the remaining tranches of load expected to be served by each utility’s SSO. FE’s third auction to secure the final 33% of their load for the 2023/2024 DY will be held on and March 20, 2023. FE’s first two auctions for the 2023/2024 DY took place in October 2022 and January 2023 and each covered 33% of their SSO load. The clearing price of those auctions are 12.23¢ and 9.77¢ per kWh, respectively.

AES Ohio’s final auctions will be held on April 4, 2023, in which they plan to secure 25% of their remaining load for the 2023/2024 DY through a 12-month product and 40% of their load through a 24-month product. AES Ohio’s first SSO auction on November 28, 2022 secured 35% of their SSO load and cleared at a price of 11.34¢ per kWh.

In comments filed at the Public Utilities Commission of Ohio (PUCO) in December 2022, Brakey Energy predicted that many of the high SSO auction results were principally a byproduct of excessive risk sensitivity of power wholesalers and that this phenomenon would self-correct. Recent auction results seem to indicate that this is occurring.

Brakey Energy will continue to monitor the final SSO auctions for FE and AES Ohio and will report outcomes in future newsletters. If you have any questions about the SSO auction process or about SSO rates for any of Ohio’s electric distribution utilities (EDUs), please contact Katie Emling.

PJM Releases Base Residual Auction Results for 2024/2025 Delivery Year

On February 27, 2023, PJM Interconnection (PJM) released the results of the base residual auction (BRA) capacity prices for the 2024/2025 delivery year after months of delay. The actual BRA took place in December 2022, but due to unforeseen issues surrounding the Reliability Requirement of Delmarva South, PJM submitted a request to the Federal Energy Regulatory Commission to enable PJM to intervene and ensure just and reasonable results consistent with the reliability requirements of each Locational Deliverability Area.

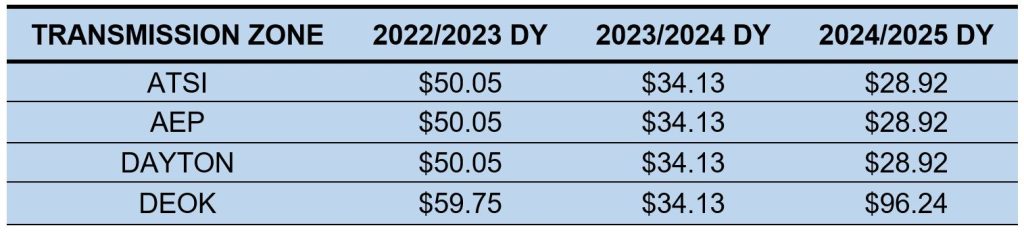

Capacity prices for the 2024/2025 DY in most western PJM markets where Ohio’s transmission zones are located resulted in a capacity price decrease of approximately 15% compared to the 2023/2024 DY price. One exception however is that the capacity price for Duke Energy Ohio and Kentucky (DEOK), which is Duke’s transmission zone, resulted in an increase of approximately 182% compared to the 2023/2024 DY capacity price. The table below summarizes the capacity prices for current and next two DY for the transmission zones located within Ohio: American Transmission Systems, Incorporated, or ATSI (FE), AEP, Dayton (AES Ohio), and DEOK.

Table 1: PJM BRA Capacity Clearing Prices by DY

The BRAs for the 2025/2026 and 2026/2026 DYs are scheduled for June and November 2023, respectively. We will continue to monitor upcoming PJM BRA or Incremental Auctions and report outcomes in future newsletters. If you have any questions about PJM’s wholesale market auctions for capacity, please contact Katie Emling.

Residential Corner

We have been recommending since October 2021 that customers with expiring contracts default to the SSO until Spring 2023. Customers can either wait one more month before contracting, or there is an 8-month 5.79¢ offer from Direct Energy that will be significantly lower than residential SSO rates beginning June 2023.

Regarding natural gas, AEP Energy is currently offering a 12-month fixed price contract for $4.39 per Mcf with no early termination fees. Customers can cancel at any time and enter into a lower priced agreement if it becomes available. Please note that the price listed will vary based on service territory.

Natural Gas Market Update

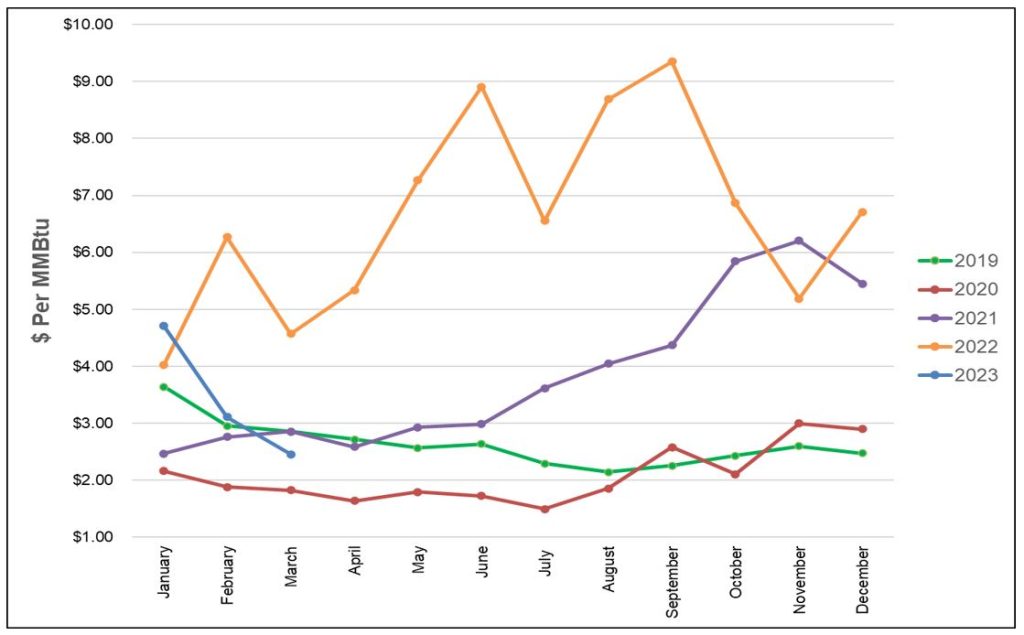

The NYMEX price for March settled at $2.451 per Million British Thermal Units (MMBtu) on February 24, 2023. This price is down 21.2% from February’s price of $3.109 per MMBtu. This settlement price is used to calculate March gas supply costs for customers that contract for a NYMEX-based index gas product.

The graph below shows the year-over-year monthly NYMEX settlement prices for 2019, 2020, 2021, 2022, and 2023 to-date. Prices shown are in dollars per MMBtu of natural gas.

Figure 1: NYMEX Monthly Natural Gas Settlement Prices

Figure 2 below shows the historical March 20, 2021 through March 20, 2023 Around the Clock (ATC) forward NYMEX natural gas prices in dollars per MMBtu for the balance of 2023 (labeled “Custom Strip” in the graph below) and calendar years 2024, 2025, 2026, and 2027. Natural gas prices for the balance of 2023 and calendar year 2024 are trading at lower levels as compared to outlier years, reflecting a state of contango in the market after a long period of backwardation.

Figure 2: ATC Calendar Year NYMEX Natural Gas Prices

*Pricing courtesy of Direct Energy Business.

Electricity Market Update

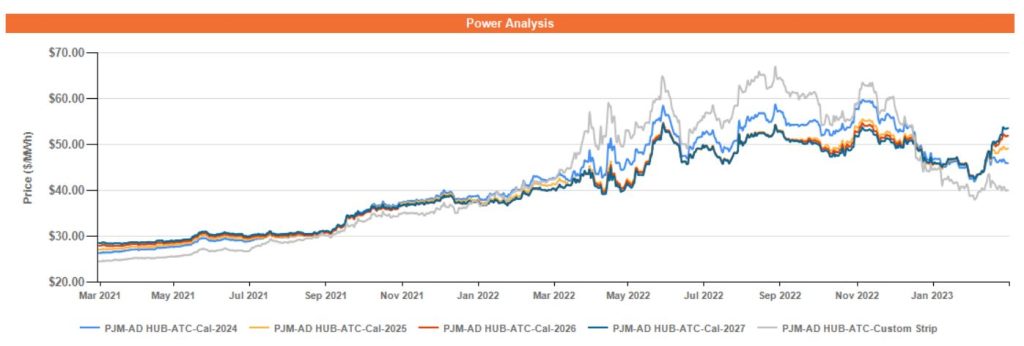

Figure 3 below shows the historical March 20, 2021 through March 20, 2023 ATC forward power prices in dollars per Megawatt hour (MWh) for the balance of 2023 (labeled “Custom Strip” in the graph below) and calendar years 2024, 2025, 2026, and 2027 for the AD Hub. Power prices have followed falling gas prices. In recent weeks we have started to see prices for calendar years 2024 through 2027 separate from each other despite following similar peaks and valleys.

Figure 3: ATC Calendar Year Power Prices for the AD Hub

* Pricing courtesy of Direct Energy Business.